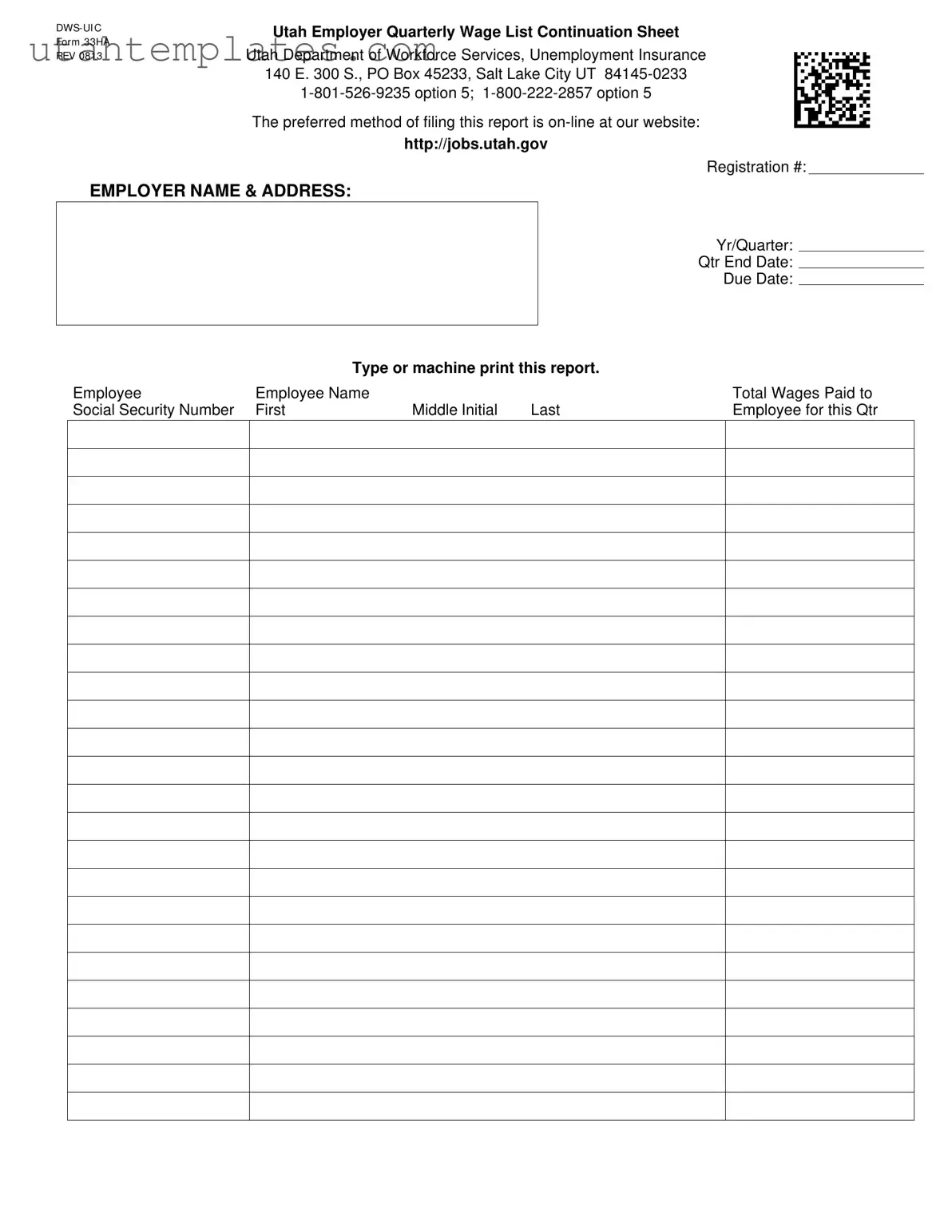

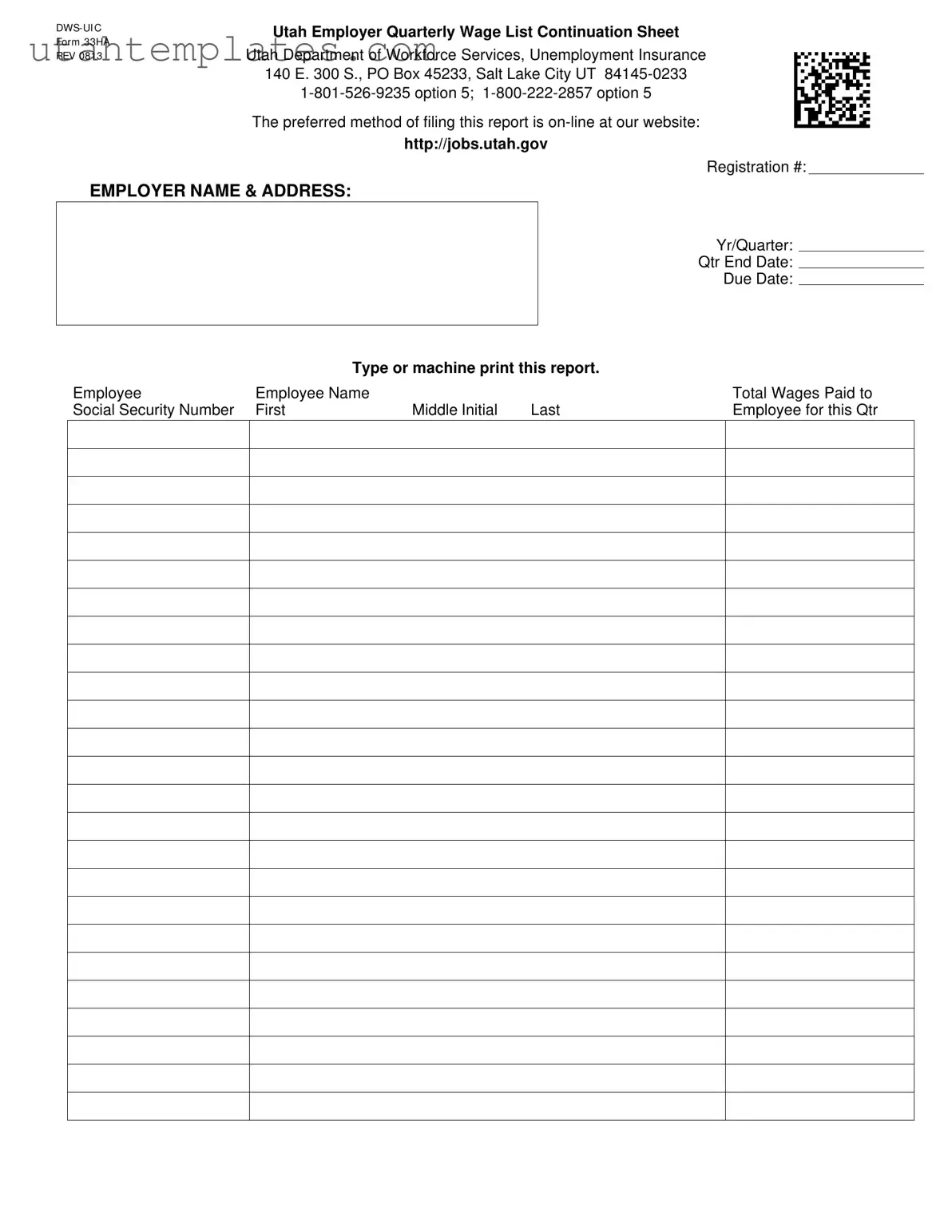

Completing the Jobs Utah Gov form can be straightforward, but many individuals encounter common mistakes that can lead to delays or issues with processing. One frequent error is not providing the correct registration number. This number is crucial for identifying the employer and ensuring that the report is linked to the appropriate account. Double-checking this detail can save time and prevent confusion.

Another common mistake involves the incomplete employee information. Each employee's name must be fully listed, including first, middle initial, and last name. Omitting any part of this information can lead to discrepancies and may require further clarification from the employer.

Many people also forget to include the Social Security Number for each employee. This number is essential for accurate wage reporting and tax purposes. Without it, the report may be deemed incomplete, which can result in penalties or additional follow-up requests.

Inaccurate wage reporting is another issue that arises frequently. Employers should ensure that the total wages paid to each employee for the quarter are reported correctly. Mistakes in this area can lead to overpayments or underpayments in unemployment insurance contributions.

Some individuals neglect to specify the year and quarter on the form. It is important to clearly indicate which quarter the report pertains to, as this information helps in organizing and processing the data accurately. Missing this detail can lead to administrative challenges.

Additionally, many users fail to observe the due date for submitting the report. Late submissions can incur fines or penalties. Being aware of the timeline is critical for compliance with state regulations.

Filing the report online is the preferred method, yet some individuals still opt for paper submissions. While this is allowed, it can be less efficient and may lead to longer processing times. Utilizing the online platform can streamline the process and reduce the likelihood of errors.

Another mistake involves not keeping a copy of the submitted report. Retaining a copy is important for record-keeping and can be useful in case of any future inquiries or audits. It serves as proof of submission and can help clarify any discrepancies that may arise later.

Lastly, individuals sometimes overlook the importance of reviewing the entire form before submission. Taking a moment to double-check all entries can prevent many of the aforementioned errors. A thorough review can help ensure that the form is complete and accurate, facilitating a smoother processing experience.