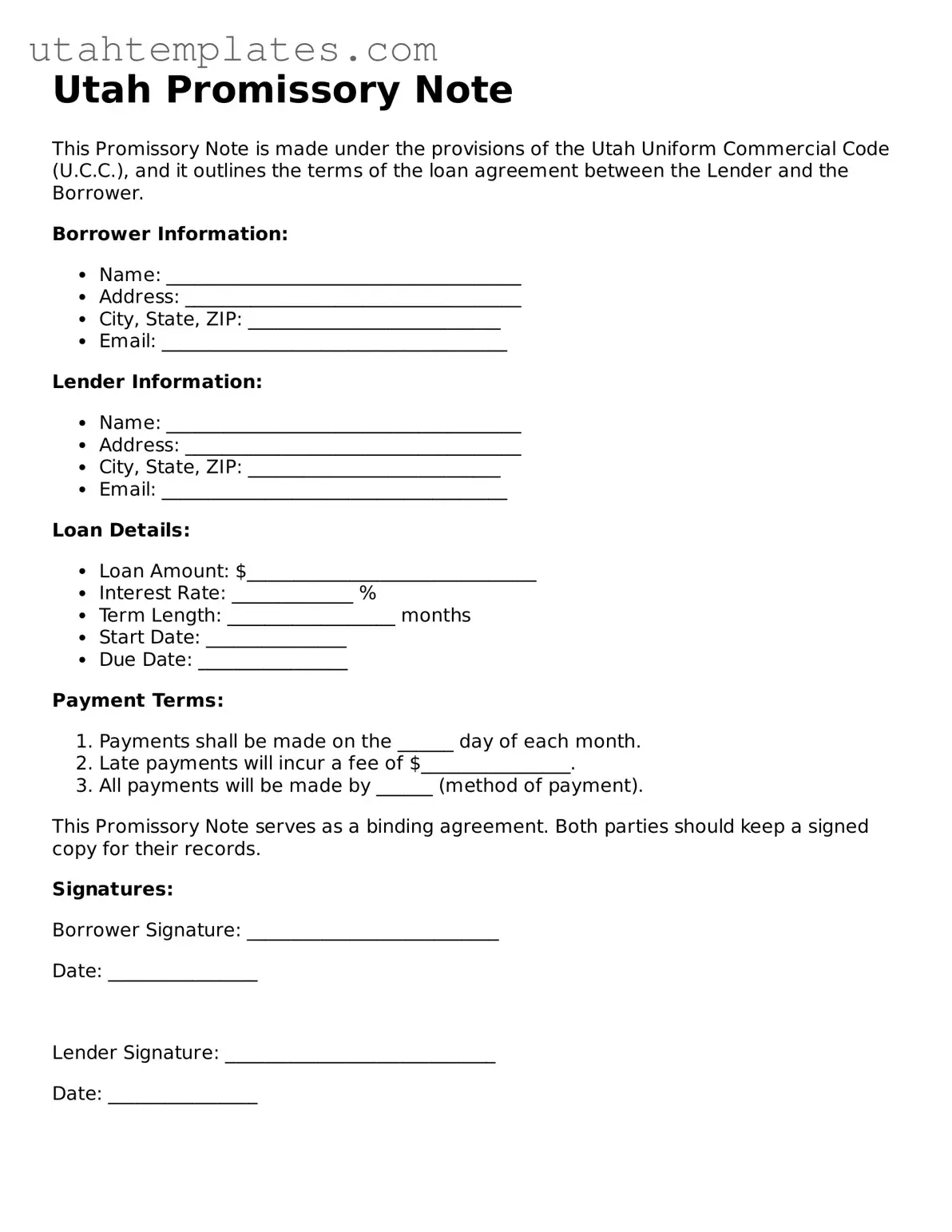

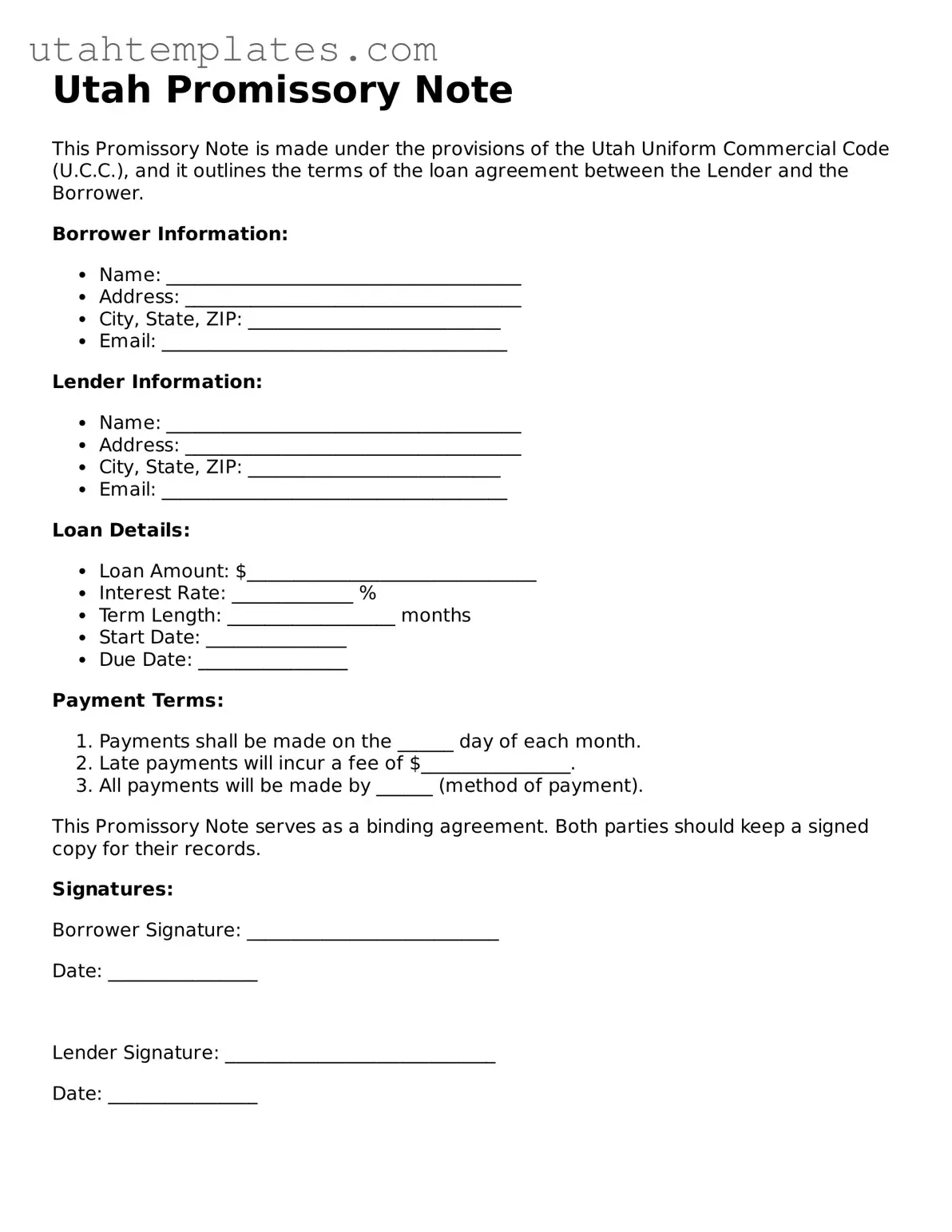

Filling out a Utah Promissory Note form requires careful attention to detail. One common mistake is failing to clearly identify the parties involved. Both the borrower and the lender must be named explicitly, including their legal names and contact information. Omitting this information can lead to confusion and potential disputes later on.

Another frequent error is neglecting to specify the loan amount. It is crucial to write the amount in both numerical and written form. This dual representation helps prevent misunderstandings regarding the exact sum being borrowed. A simple mistake in the figures can create significant issues down the line.

Many individuals overlook the importance of detailing the interest rate. The form should explicitly state whether the loan is interest-free or includes a specific rate. If an interest rate is applicable, it must comply with Utah's usury laws. Failure to do so can result in the note being unenforceable.

Additionally, borrowers often forget to include the repayment terms. This section should outline when payments are due, how they should be made, and the duration of the loan. Vague repayment terms can lead to confusion and potential legal challenges, making it essential to be as clear as possible.

Another mistake involves the lack of a signature from both parties. A Promissory Note is not valid unless it is signed by the borrower and the lender. Without these signatures, the agreement may not hold up in court, leaving both parties vulnerable.

Some people fail to date the document. A date is crucial as it establishes when the agreement was made. This information can be vital for determining deadlines and other time-sensitive aspects of the loan.

It is also important to consider the witness requirement. While not always necessary, having a witness can add an extra layer of security to the agreement. Not including a witness when one is required could undermine the validity of the note.

Moreover, individuals often neglect to keep copies of the signed Promissory Note. Both the borrower and the lender should retain a copy for their records. This practice ensures that both parties have access to the terms of the agreement in case of future disputes.

Finally, not consulting with a legal professional can be a significant oversight. While it may seem straightforward, having a knowledgeable advisor review the document can help identify potential issues before they become serious problems. Taking this precaution can save time, money, and stress in the long run.