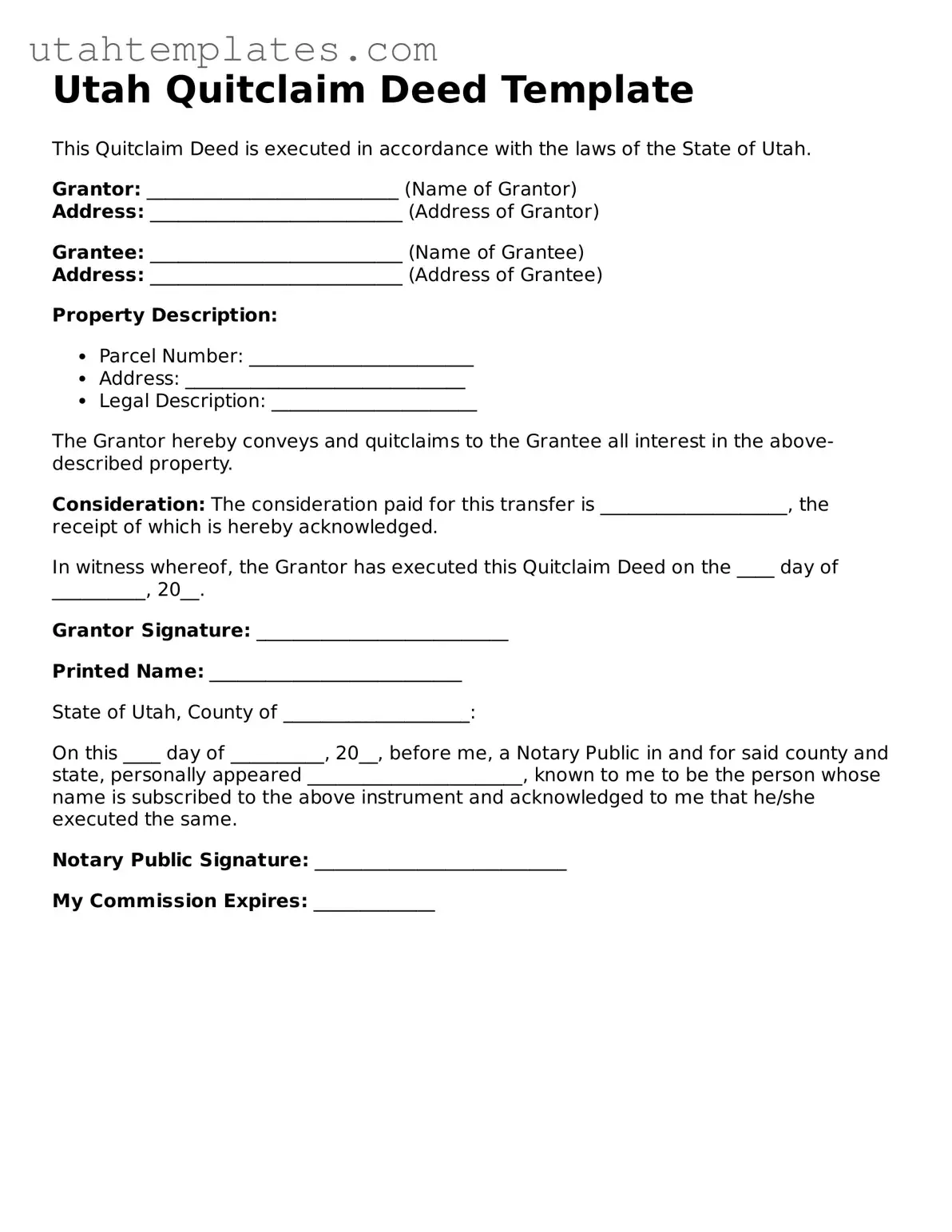

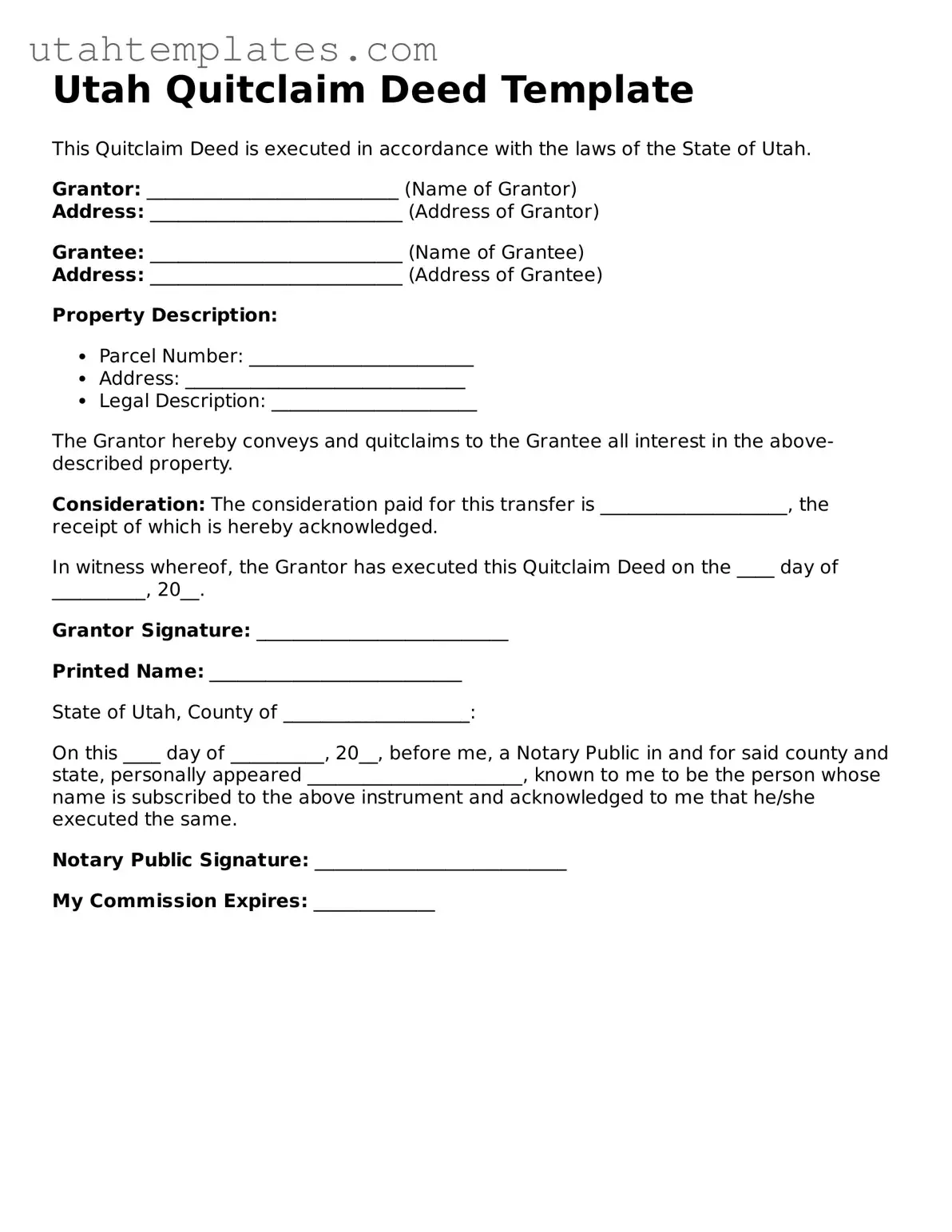

Free Quitclaim Deed Form for Utah

A Utah Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form allows the grantor to relinquish any claim they may have on the property, making it a straightforward option for transferring property rights. Understanding how to properly complete and file this deed is essential for ensuring a smooth transfer process.

Launch Quitclaim Deed Editor Here

Free Quitclaim Deed Form for Utah

Launch Quitclaim Deed Editor Here

Need to check this off quickly?

Fill out Quitclaim Deed online without dealing with paper.

Launch Quitclaim Deed Editor Here

or

Free PDF File