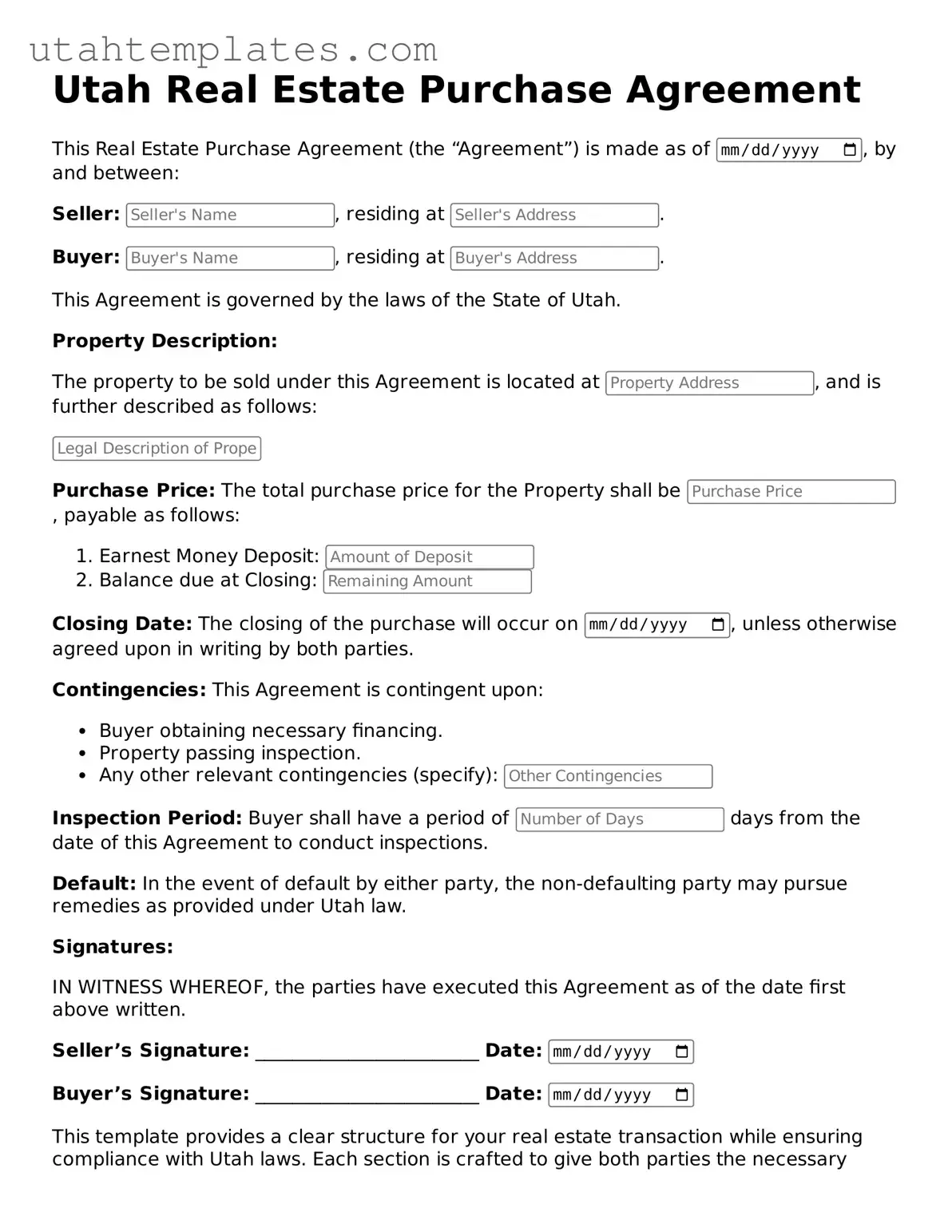

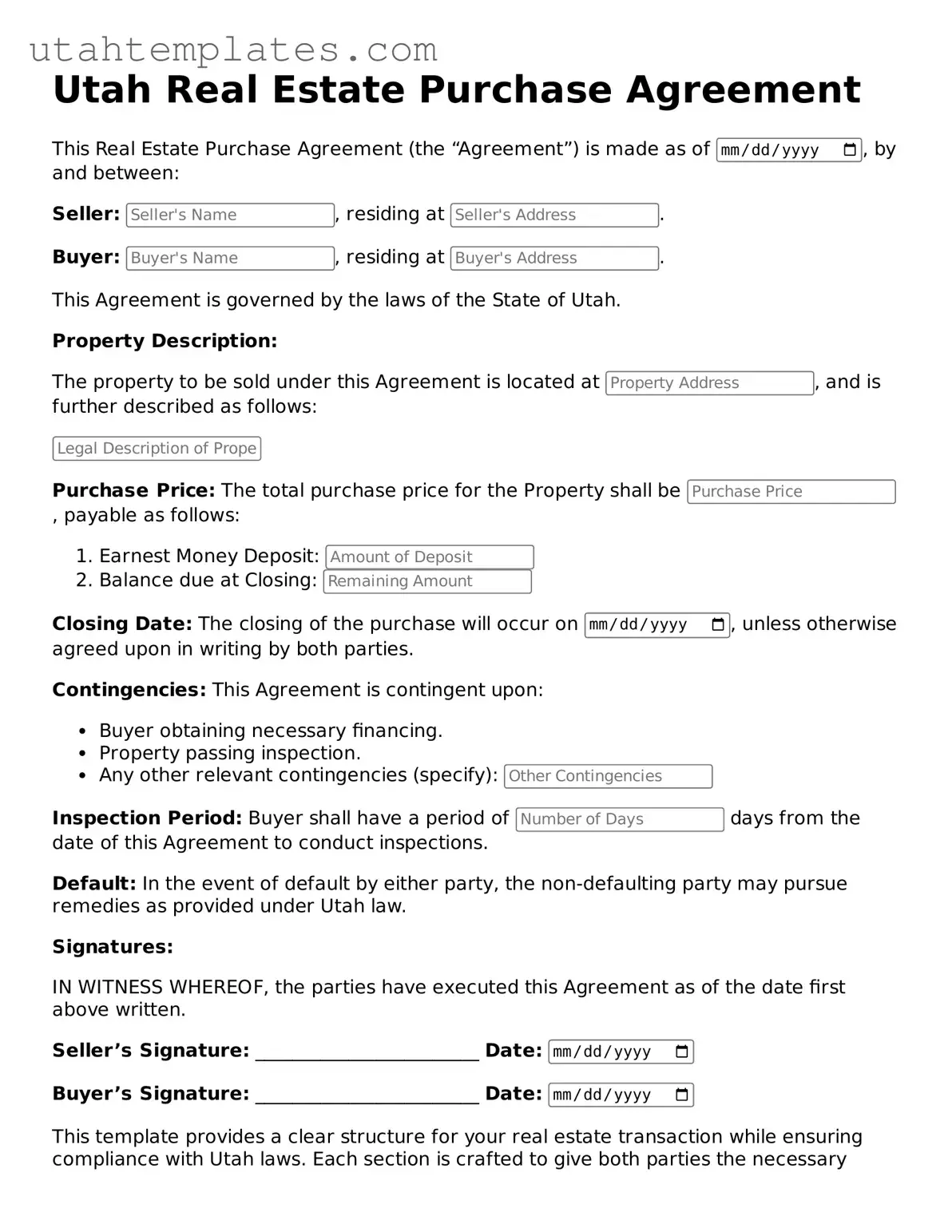

Free Real Estate Purchase Agreement Form for Utah

The Utah Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a property sale in Utah. This form serves as a binding contract between the buyer and seller, detailing important aspects such as price, financing, and contingencies. Understanding this agreement is essential for anyone involved in a real estate transaction in the state.

Launch Real Estate Purchase Agreement Editor Here

Free Real Estate Purchase Agreement Form for Utah

Launch Real Estate Purchase Agreement Editor Here

Need to check this off quickly?

Fill out Real Estate Purchase Agreement online without dealing with paper.

Launch Real Estate Purchase Agreement Editor Here

or

Free PDF File