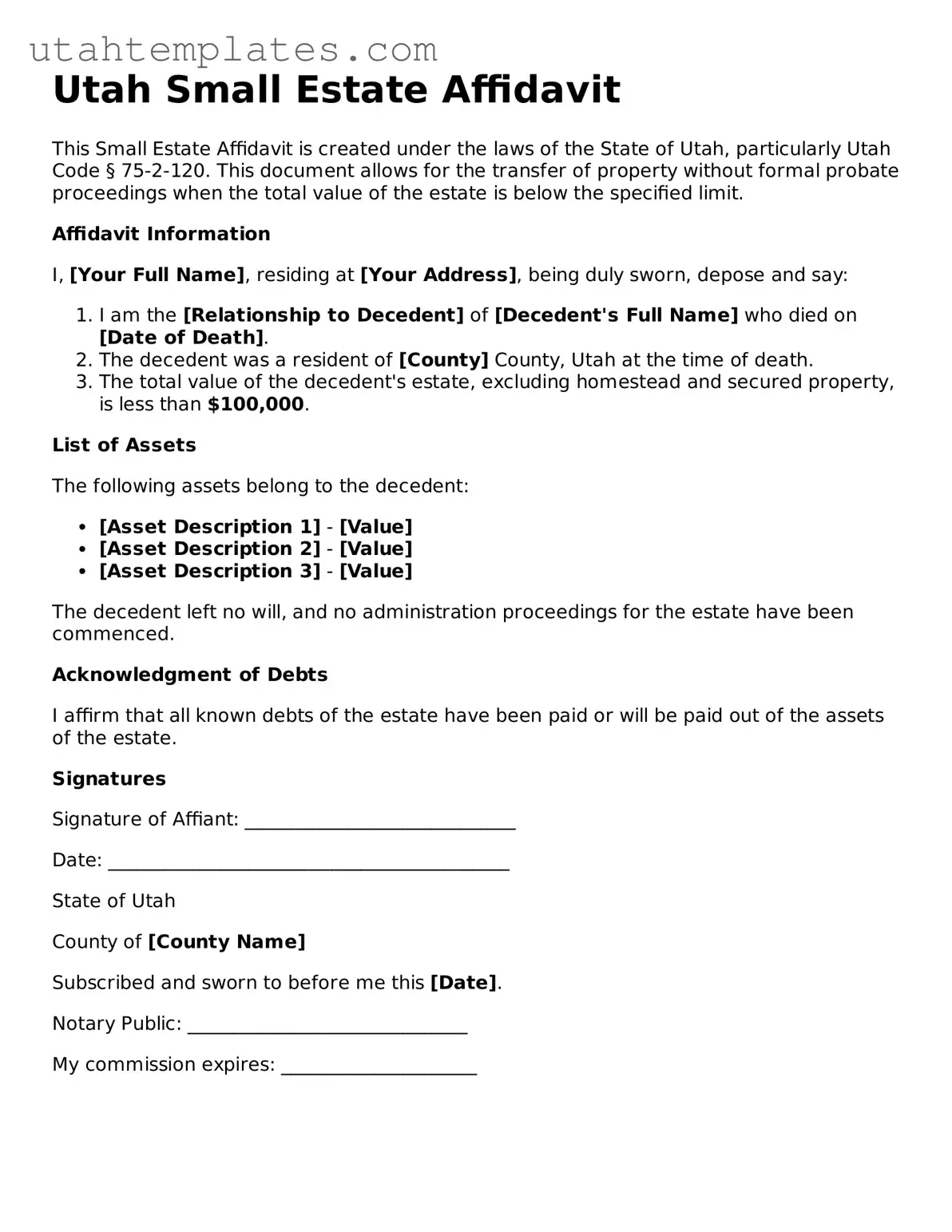

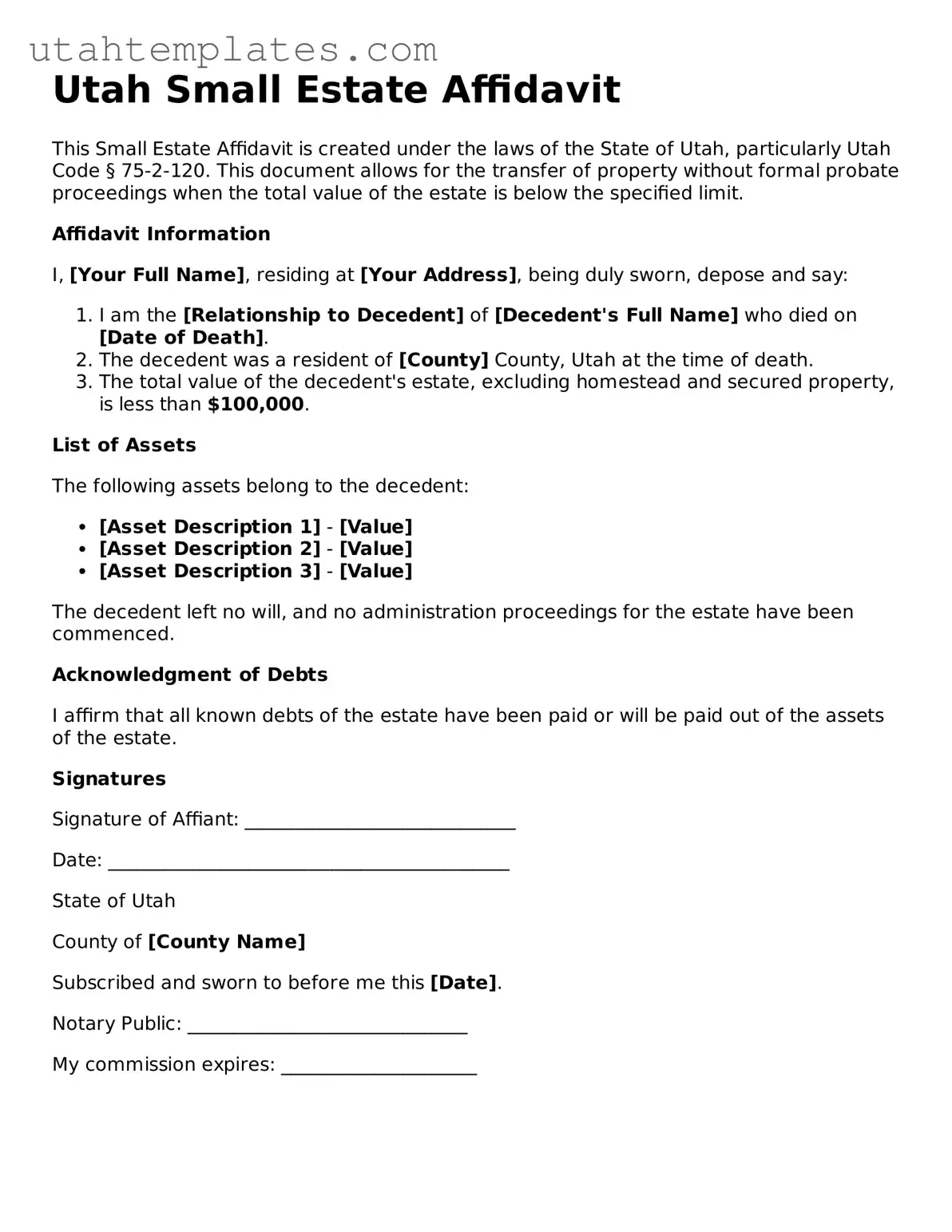

Free Small Estate Affidavit Form for Utah

The Utah Small Estate Affidavit is a legal document that allows individuals to claim the assets of a deceased person without going through the lengthy probate process. This form simplifies the transfer of property when the total value of the estate falls below a specified threshold. Understanding how to properly use this affidavit can ease the burden during a difficult time.

Launch Small Estate Affidavit Editor Here

Free Small Estate Affidavit Form for Utah

Launch Small Estate Affidavit Editor Here

Need to check this off quickly?

Fill out Small Estate Affidavit online without dealing with paper.

Launch Small Estate Affidavit Editor Here

or

Free PDF File