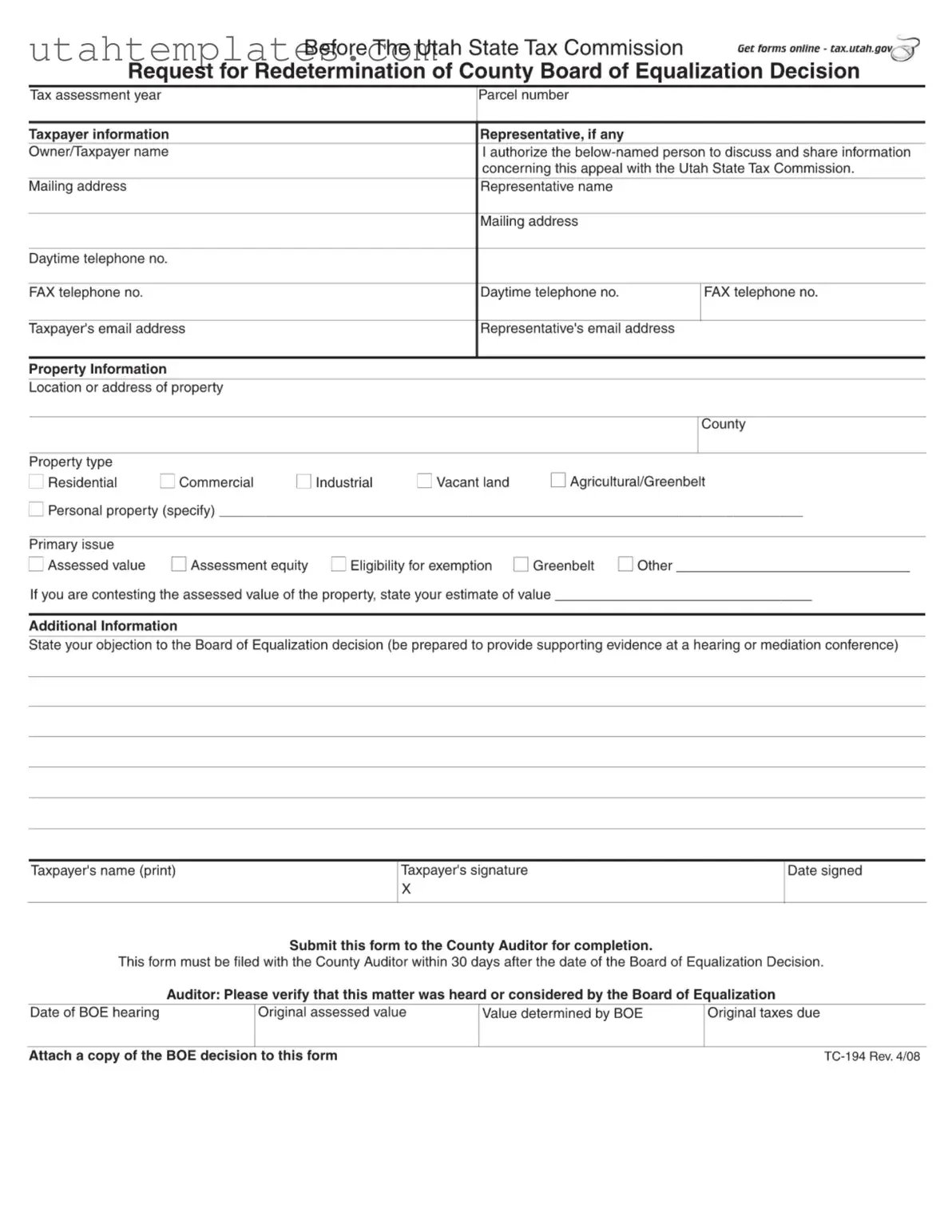

Blank Tc 194 Utah Form

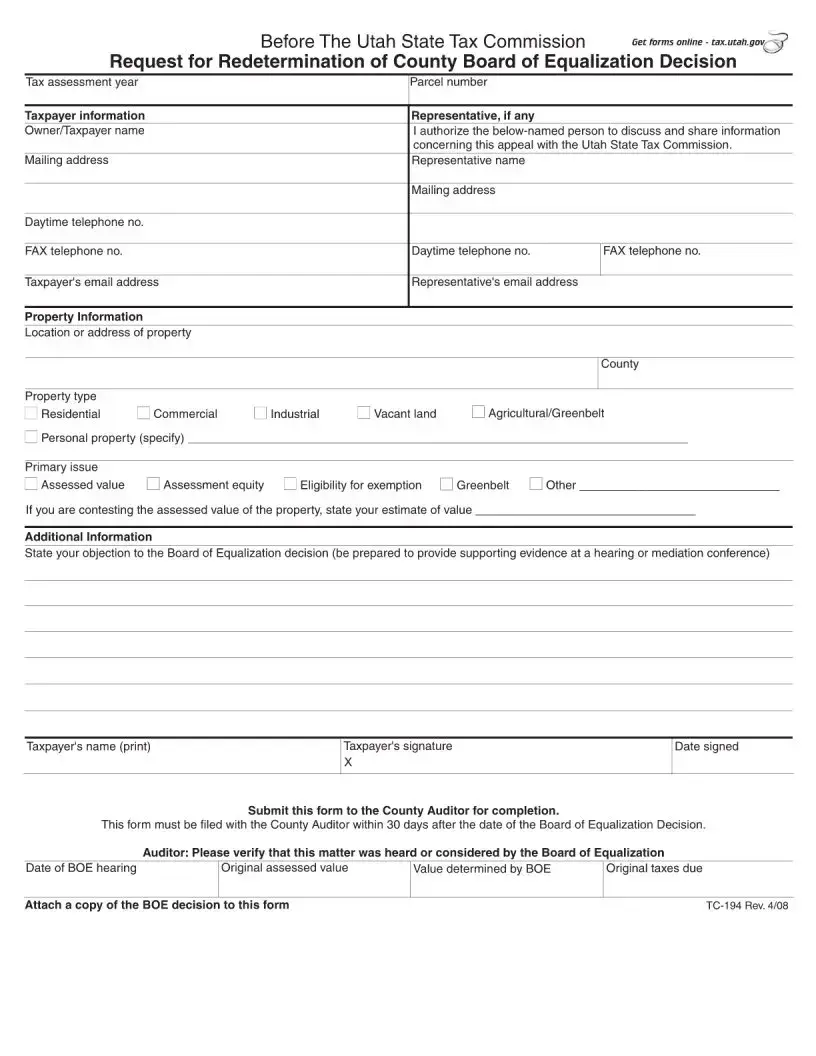

The Tc 194 Utah form serves as a formal request for redetermination of a decision made by the County Board of Equalization regarding property tax assessments. This document allows taxpayers to contest issues such as assessed value, assessment equity, and eligibility for exemptions. By submitting the Tc 194, property owners can seek a review of the Board's decision within a specified timeframe, ensuring their concerns are heard and addressed.

Launch Tc 194 Utah Editor Here

Blank Tc 194 Utah Form

Launch Tc 194 Utah Editor Here

Need to check this off quickly?

Fill out Tc 194 Utah online without dealing with paper.

Launch Tc 194 Utah Editor Here

or

Free PDF File