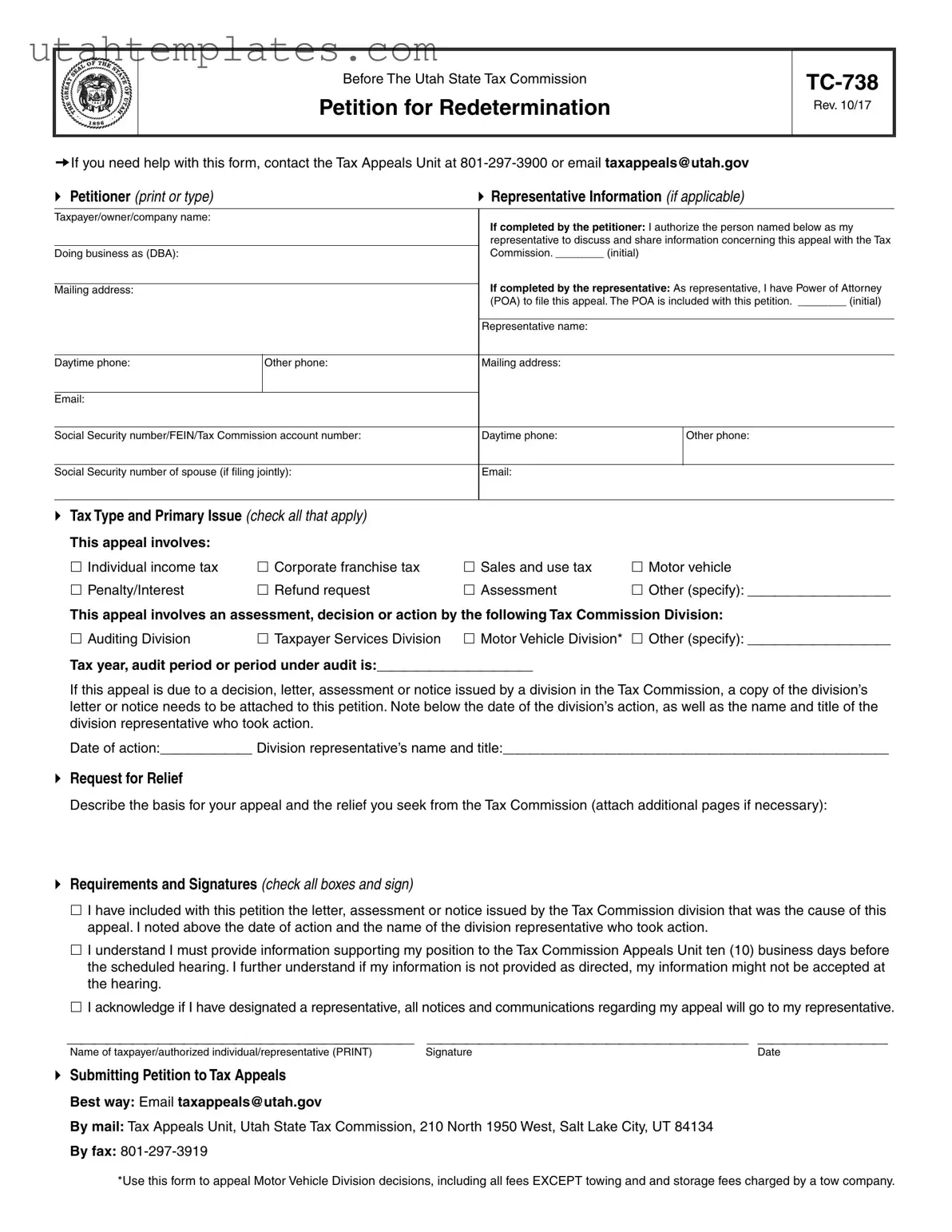

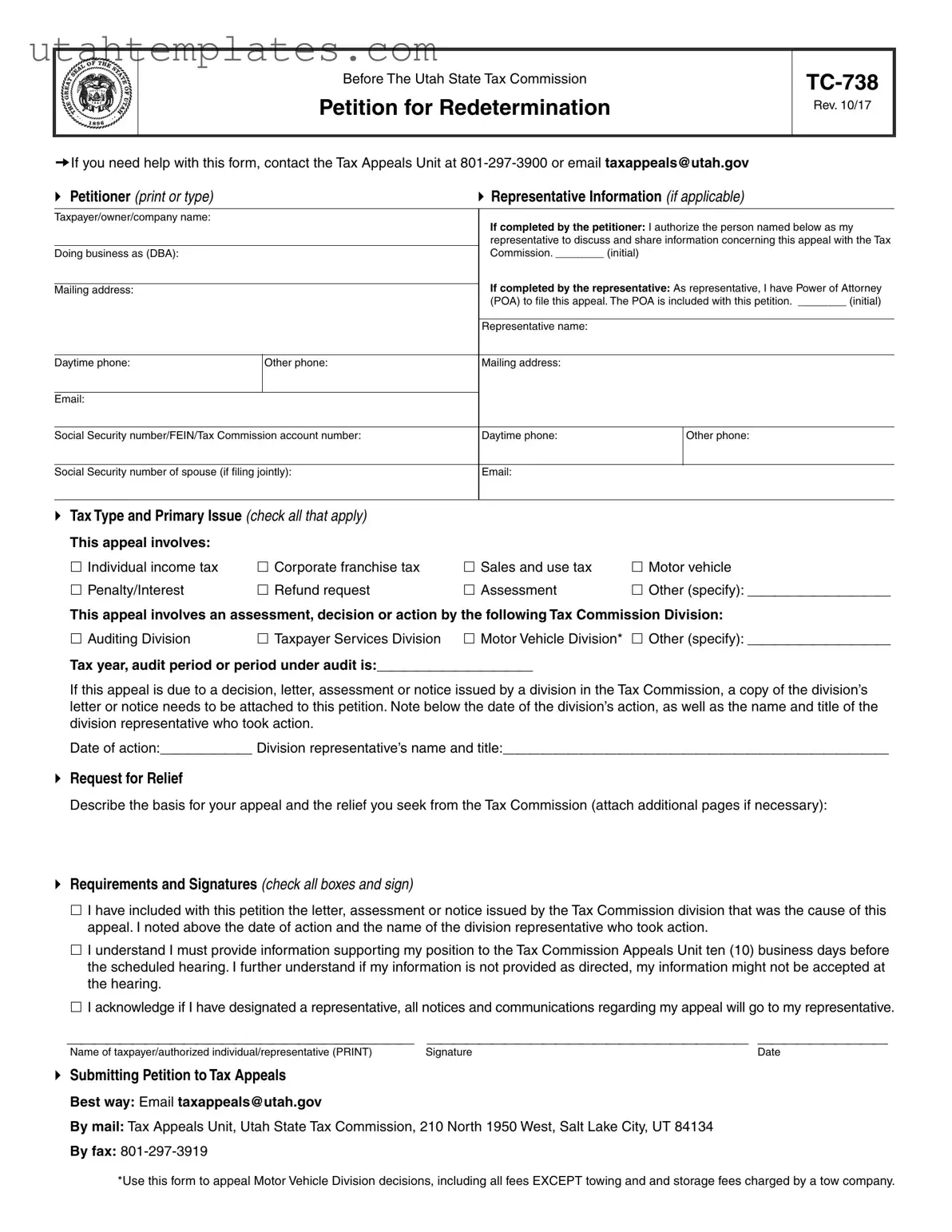

Tax Type and Primary Issue (check all that apply)

This appeal involves: |

|

|

|

Individual income tax |

Corporate franchise tax |

Sales and use tax |

Motor vehicle |

Penalty/Interest |

Refund request |

Assessment |

Other (specify): ___________ |

This appeal involves an assessment, decision or action by the following Tax Commission Division: |

Auditing Division |

Taxpayer Services Division |

Motor Vehicle Division* Other (specify): ___________ |

Tax year, audit period or period under audit is:____________

If this appeal is due to a decision, letter, assessment or notice issued by a division in the Tax Commission, a copy of the division’s letter or notice needs to be attached to this petition. Note below the date of the division’s action, as well as the name and title of the division representative who took action.

Date of action:_______ Division representative’s name and title:______________________________

Request for Relief

Describe the basis for your appeal and the relief you seek from the Tax Commission (attach additional pages if necessary):

Requirements and Signatures (check all boxes and sign)

I have included with this petition the letter, assessment or notice issued by the Tax Commission division that was the cause of this appeal. I noted above the date of action and the name of the division representative who took action.

I understand I must provide information supporting my position to the Tax Commission Appeals Unit ten (10) business days before the scheduled hearing. I further understand if my information is not provided as directed, my information might not be accepted at the hearing.

I acknowledge if I have designated a representative, all notices and communications regarding my appeal will go to my representative.

___________________________ _________________________ __________

Name of taxpayer/authorized individual/representative (PRINT) |

Signature |

Date |

Submitting Petition to Tax Appeals

Best way: Email taxappeals@utah.gov

By mail: Tax Appeals Unit, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT 84134

By fax: 801-297-3919

*Use this form to appeal Motor Vehicle Division decisions, including all fees EXCEPT towing and and storage fees charged by a tow company.