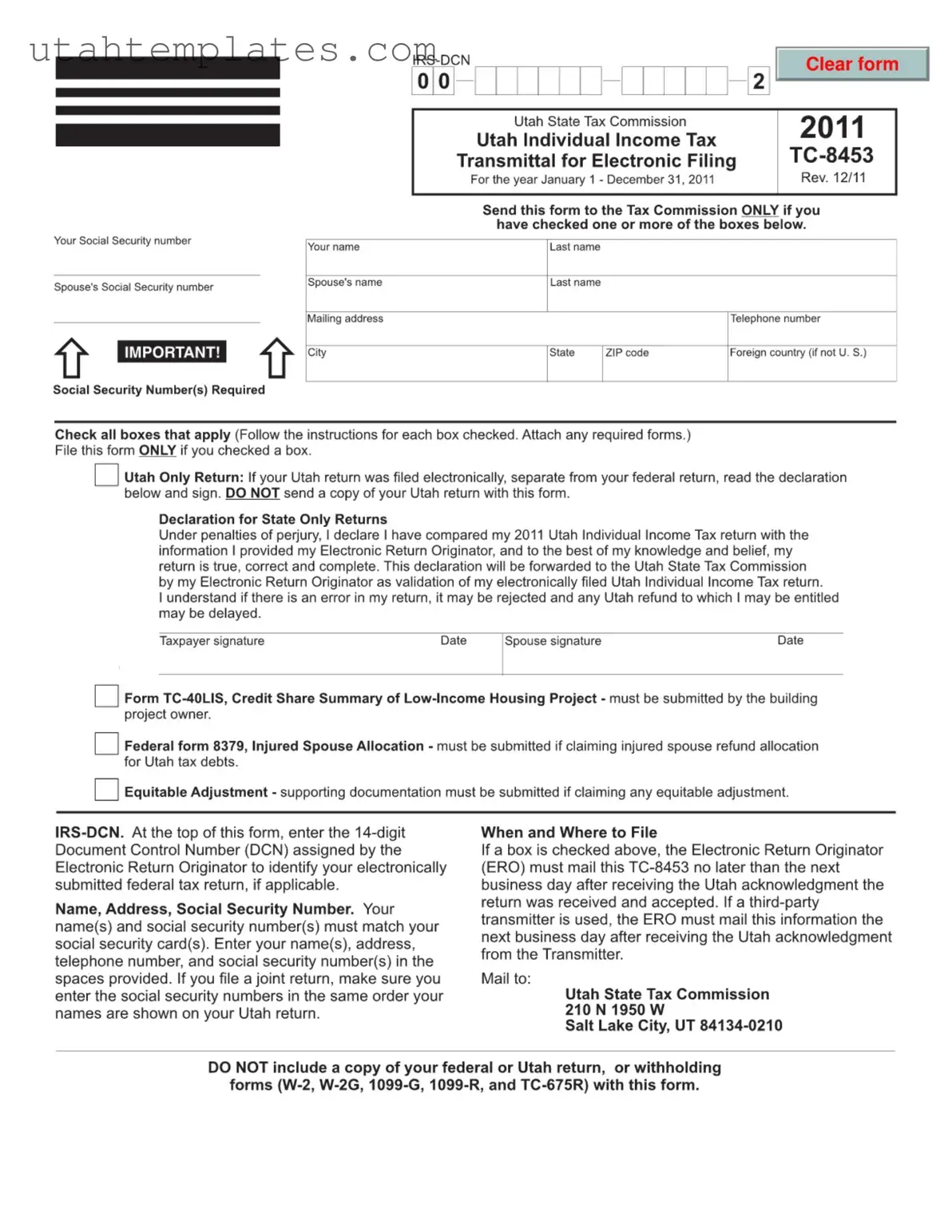

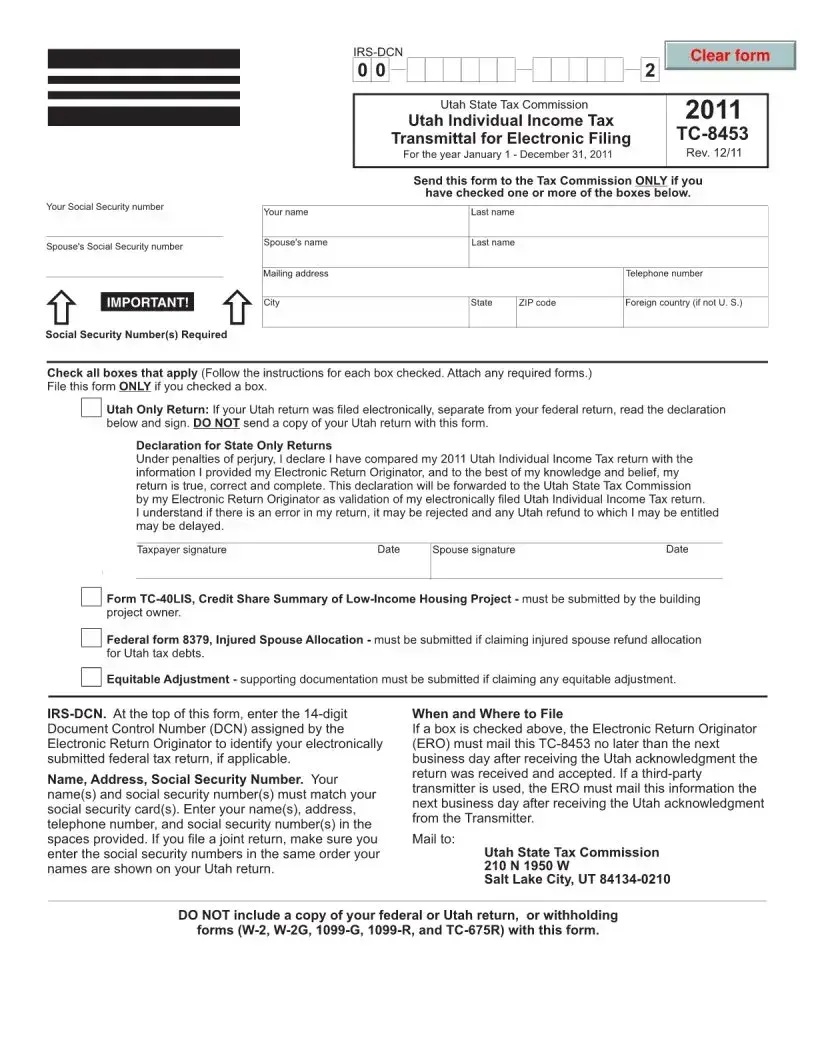

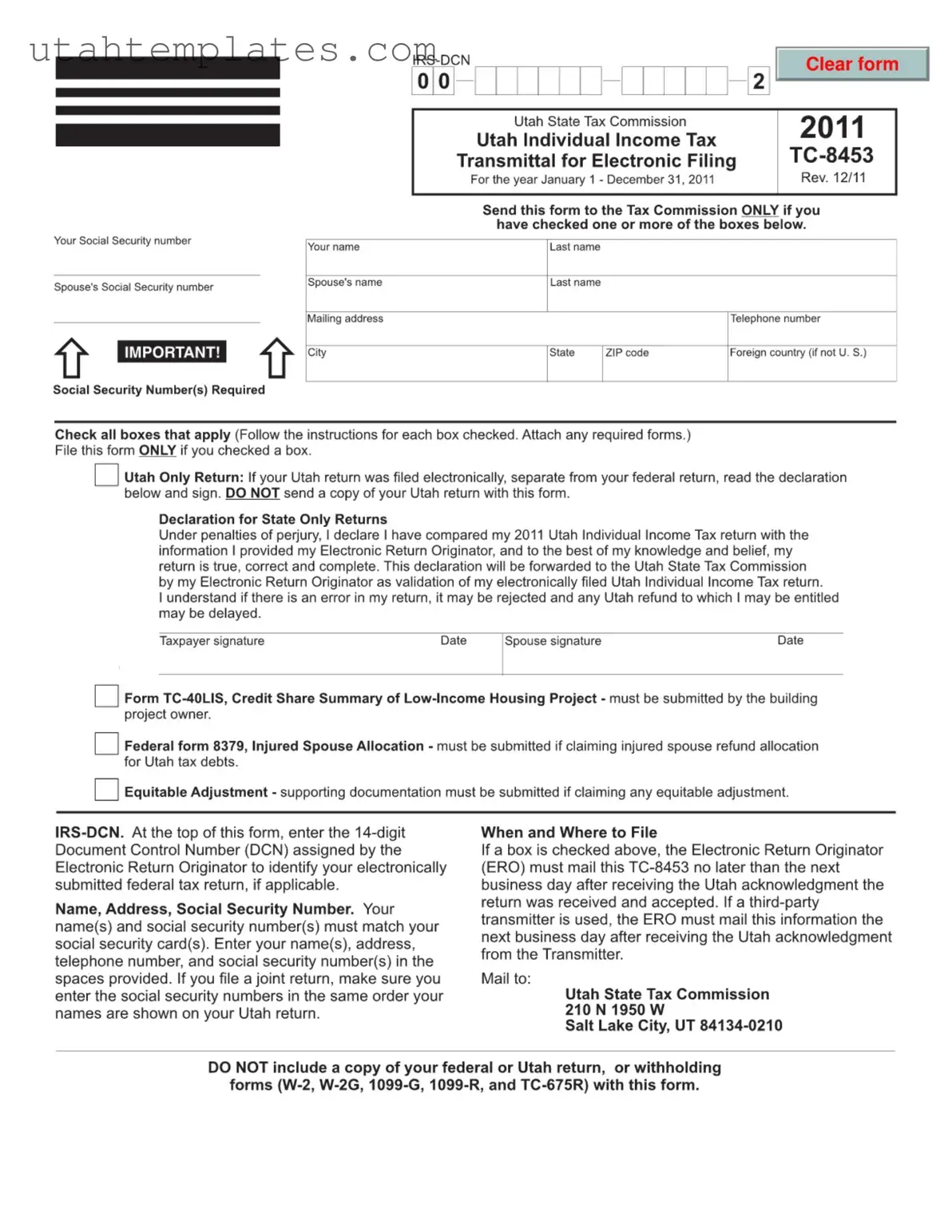

Blank Tc 8453 Utah Form

The Tc 8453 Utah form serves as the Utah Individual Income Tax Transmittal for Electronic Filing, a crucial document for taxpayers who file their state returns electronically. This form is necessary to validate the submission of your Utah tax return, ensuring that all provided information is accurate and complete. Understanding how to properly complete and submit this form can help prevent delays in receiving any potential refunds.

Launch Tc 8453 Utah Editor Here

Blank Tc 8453 Utah Form

Launch Tc 8453 Utah Editor Here

Need to check this off quickly?

Fill out Tc 8453 Utah online without dealing with paper.

Launch Tc 8453 Utah Editor Here

or

Free PDF File