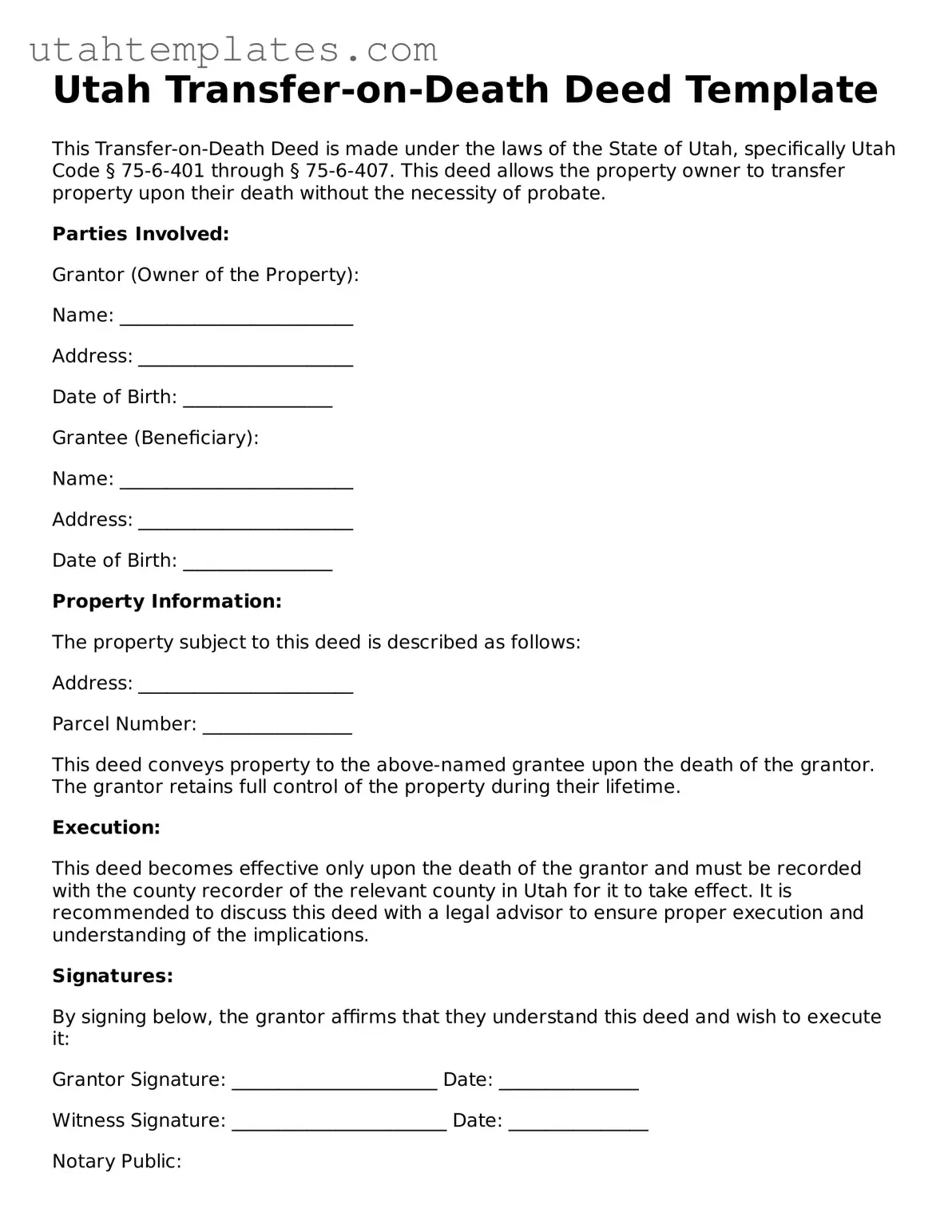

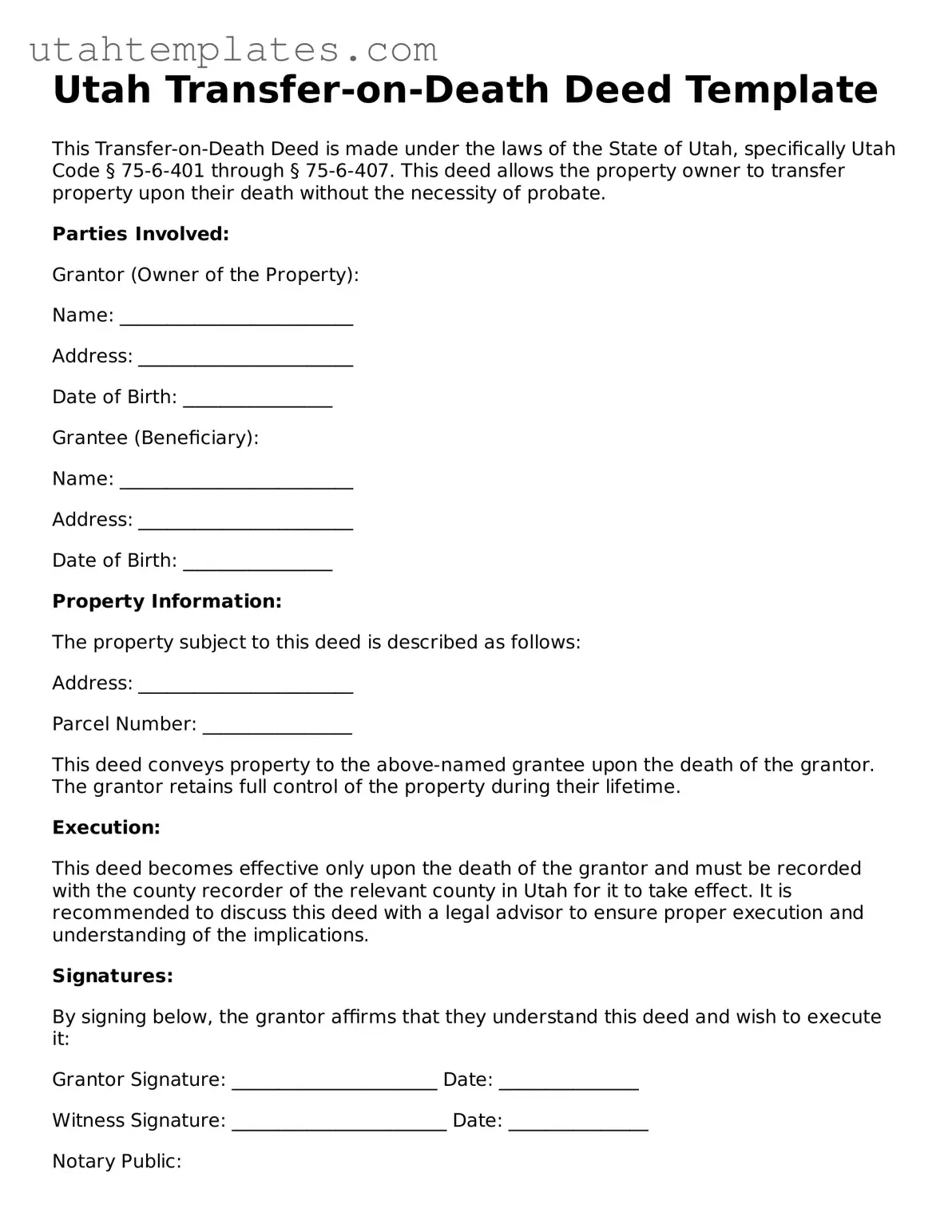

Free Transfer-on-Death Deed Form for Utah

The Utah Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This legal tool provides a straightforward way to transfer ownership, ensuring that your property goes directly to your chosen heirs. Understanding this form can help you make informed decisions about your estate planning.

Launch Transfer-on-Death Deed Editor Here

Free Transfer-on-Death Deed Form for Utah

Launch Transfer-on-Death Deed Editor Here

Need to check this off quickly?

Fill out Transfer-on-Death Deed online without dealing with paper.

Launch Transfer-on-Death Deed Editor Here

or

Free PDF File