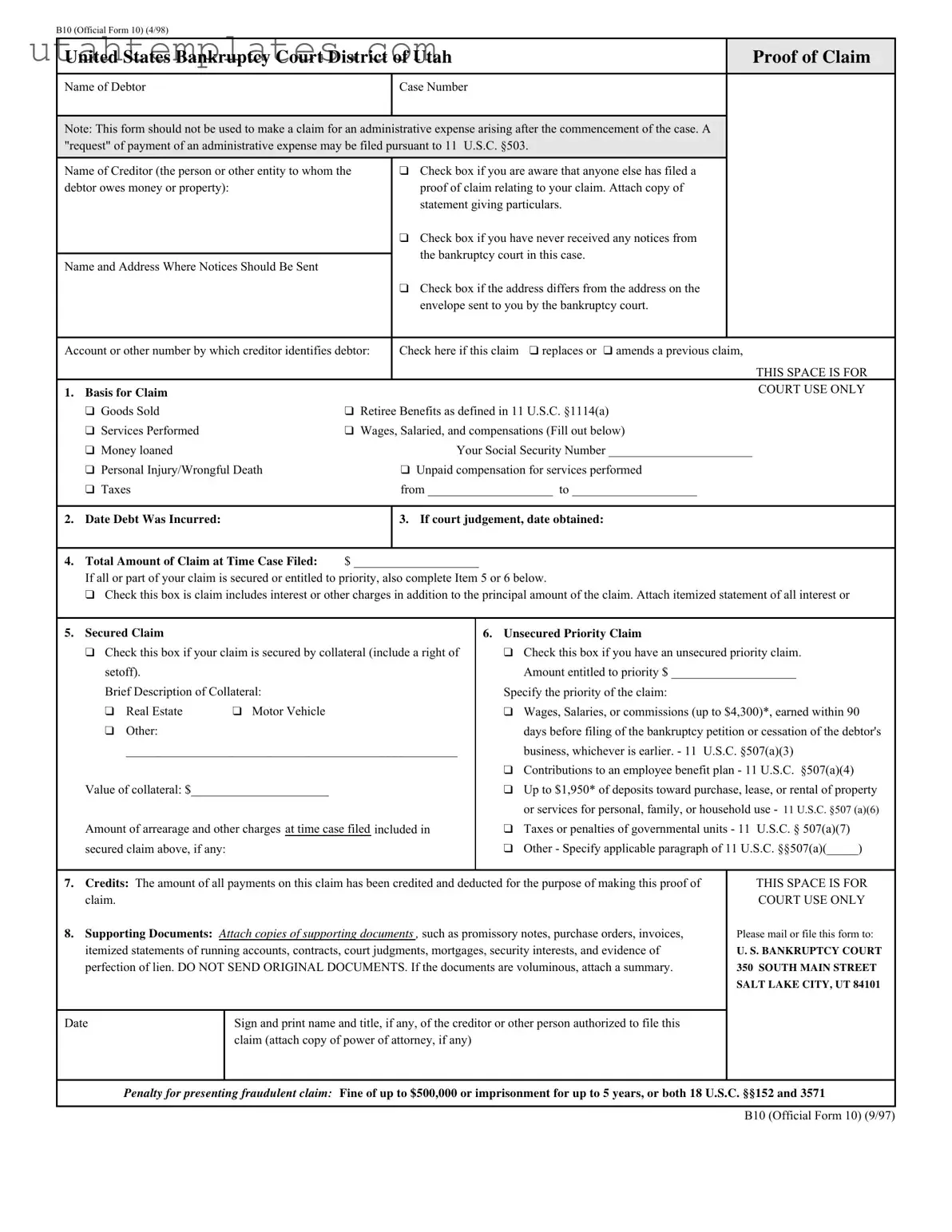

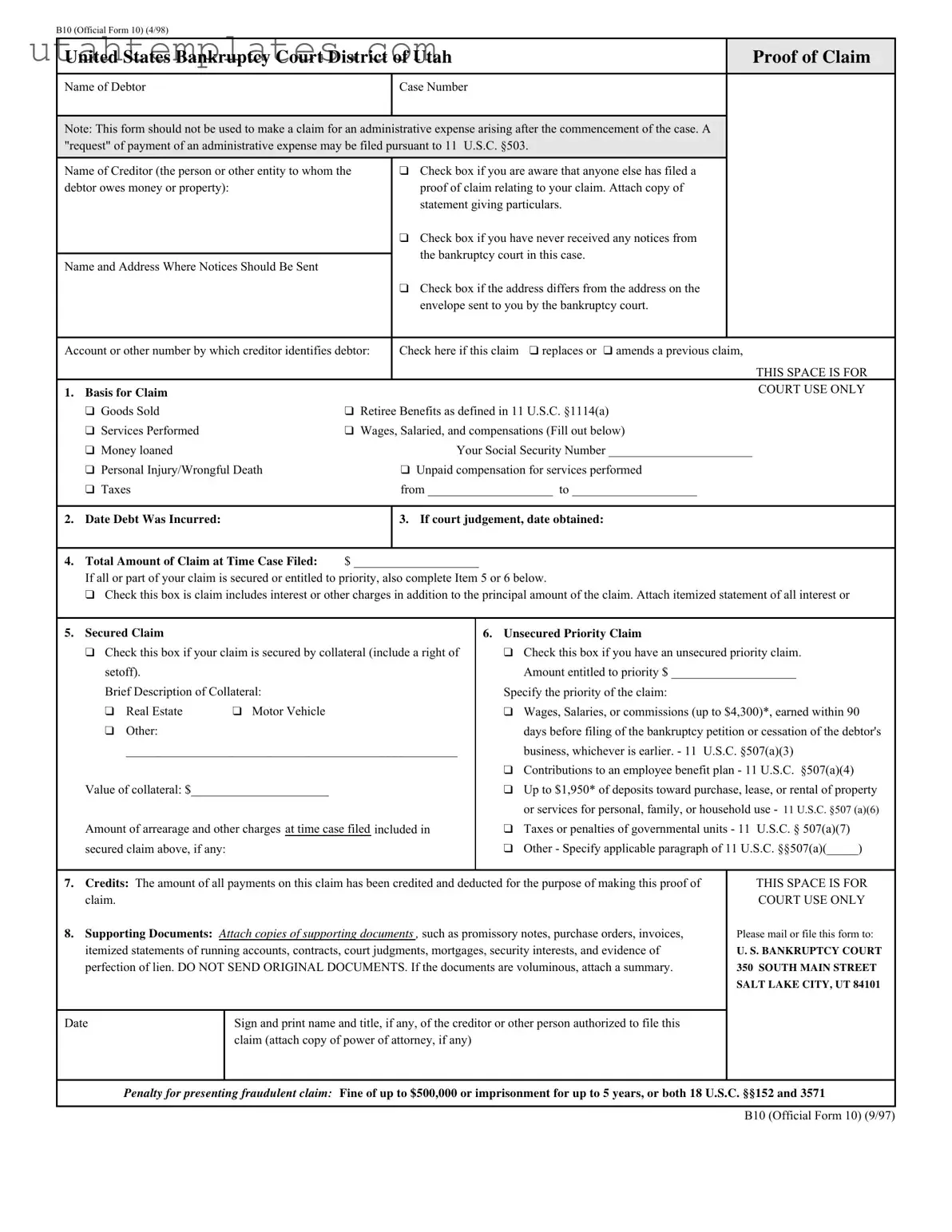

United States Bankruptcy Court District of Utah |

|

|

|

Proof of Claim |

|

|

|

|

|

|

|

|

|

|

Name of Debtor |

|

|

Case Number |

|

|

|

|

|

|

|

|

|

Note: This form should not be used to make a claim for an administrative expense arising after the commencement of the case. A |

|

"request" of payment of an administrative expense may be filed pursuant to 11 U.S.C. §503. |

|

|

Name of Creditor (the person or other entity to whom the |

|

Check box if you are aware that anyone else has filed a |

|

debtor owes money or property): |

|

|

proof of claim relating to your claim. Attach copy of |

|

|

|

|

|

|

|

|

statement giving particulars. |

|

|

|

|

|

|

|

|

|

Check box if you have never received any notices from |

|

|

|

|

|

|

|

the bankruptcy court in this case. |

|

|

Name and Address Where Notices Should Be Sent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check box if the address differs from the address on the |

|

|

|

|

|

|

|

|

envelope sent to you by the bankruptcy court. |

|

|

|

|

|

|

|

|

Account or other number by which creditor identifies debtor: |

Check here if this claim |

replaces or |

amends a previous claim, |

|

|

|

|

|

|

|

|

|

|

|

|

THIS SPACE IS FOR |

1. |

Basis for Claim |

|

|

|

|

|

|

|

|

COURT USE ONLY |

|

|

|

|

|

|

|

|

|

|

Goods Sold |

|

Retiree Benefits as defined in 11 U.S.C. §1114(a) |

|

|

Services Performed |

|

Wages, Salaried, and compensations (Fill out below) |

|

|

Money loaned |

|

|

|

Your Social Security Number _______________________ |

|

Personal Injury/Wrongful Death |

|

|

Unpaid compensation for services performed |

|

|

Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from ____________________ to ____________________ |

|

|

|

|

|

|

|

|

2. Date Debt Was Incurred: |

|

|

3. If court judgement, date obtained: |

|

|

|

|

|

|

|

|

|

|

4. Total Amount of Claim at Time Case Filed: |

$ ____________________ |

|

|

|

|

|

If all or part of your claim is secured or entitled to priority, also complete Item 5 or 6 below. |

|

|

|

Check this box is claim includes interest or other charges in addition to the principal amount of the claim. Attach itemized statement of all interest or |

|

|

|

|

|

|

|

|

|

|

5. |

Secured |

Claim |

|

|

|

|

6. |

Unsecured Priority Claim |

|

|

Check this box if your claim is secured by collateral (include a right of |

|

|

Check this box if you have an unsecured priority claim. |

|

setoff). |

|

|

|

|

|

|

Amount entitled to priority $ ____________________ |

|

Brief Description of Collateral: |

|

|

|

|

Specify the priority of the claim: |

|

|

Real Estate |

Motor Vehicle |

|

|

|

|

|

Wages, Salaries, or commissions (up to $4,300)*, earned within 90 |

|

Other: |

|

|

|

|

|

|

days before filing of the bankruptcy petition or cessation of the debtor's |

|

_____________________________________________________ |

|

|

business, whichever is earlier. - 11 U.S.C. §507(a)(3) |

|

|

|

|

|

|

|

|

|

|

Contributions to an employee benefit plan - 11 U.S.C. §507(a)(4) |

|

Value of collateral: $______________________ |

|

|

|

|

|

Up to $1,950* of deposits toward purchase, lease, or rental of property |

|

|

|

|

|

|

|

|

|

|

or services for personal, family, or household use - 11 U.S.C. §507 (a)(6) |

|

Amount of arrearage and other charges at time case filed included in |

|

|

Taxes or penalties of governmental units - 11 U.S.C. § 507(a)(7) |

|

secured claim above, if any: |

|

|

|

|

|

Other - Specify applicable paragraph of 11 U.S.C. §§507(a)(_____) |

|

|

|

|

|

7. |

Credits: The amount of all payments on this claim has been credited and deducted for the purpose of making this proof of |

THIS SPACE IS FOR |

|

claim. |

|

|

|

|

|

|

|

|

|

|

COURT USE ONLY |

8. |

Supporting Documents: Attach copies of supporting documents , such as promissory notes, purchase orders, invoices, |

Please mail or file this form to: |

|

itemized statements of running accounts, contracts, court judgments, mortgages, security interests, and evidence of |

U. S. BANKRUPTCY COURT |

|

perfection of lien. DO NOT SEND ORIGINAL DOCUMENTS. If the documents are voluminous, attach a summary. |

350 SOUTH MAIN STREET |

|

|

|

|

|

|

|

|

|

|

|

|

SALT LAKE CITY, UT 84101 |

|

|

|

|

|

Date |

|

|

Sign and print name and title, if any, of the creditor or other person authorized to file this |

|

|

|

|

|

claim (attach copy of power of attorney, if any) |

|

|

|

|

|

|

|

|

|

Penalty for presenting fraudulent claim: Fine of up to $500,000 or imprisonment for up to 5 years, or both 18 U.S.C. §§152 and 3571 |

|

|

|

|

|

|

|

|

|

|

|

|

|