Completing the Utah CPE Reporting form can be a straightforward process, but several common mistakes can hinder timely license renewal. One frequent error is failing to submit the form by the specified deadline of January 31, 2012. Missing this date can result in delays and complications in renewing your license, which is crucial for maintaining your professional standing.

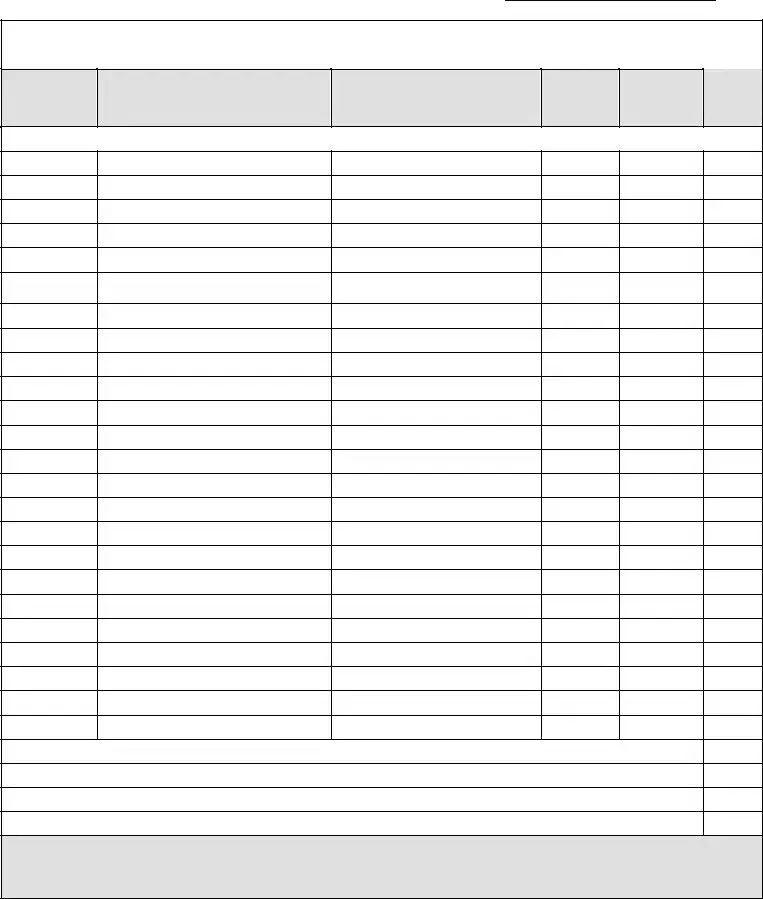

Another common mistake involves not providing complete information. The form requires specific details, such as the licensee's name and number, course titles, and hours completed. Incomplete forms may be returned, leading to further delays in processing. It is essential to double-check that all required fields are filled out accurately.

Some individuals mistakenly assume that any continuing education course qualifies for credit. However, only approved courses count toward the required 80 hours. Reporting non-qualifying hours can result in disqualification and may prevent license renewal. It is important to verify that the courses taken meet the standards set by the Utah Board of Accountancy.

Additionally, licensees often overlook the need to sign the certification at the bottom of the form. A missing signature can render the submission invalid, causing unnecessary complications. Always ensure that the form is signed before submission.

Another mistake is not keeping track of carry-over hours. If you complete more than the required 80 hours during the reporting period, you can carry forward up to 40 hours. However, failing to document this correctly can lead to confusion about your total hours and eligibility for future reporting periods.

Some licensees may not attach additional pages when necessary. If you have taken numerous courses, ensure that you provide complete documentation. Failing to include this information can lead to an incomplete submission, which may affect your renewal process.

Another error involves not providing the correct course sponsor information. Each course must be linked to an appropriate sponsor, and missing this detail can raise questions during the review process. It is crucial to ensure that all course sponsors are accurately listed.

Many licensees also forget to include the CPE number for each course. This number is essential for tracking and verifying the courses taken. Omitting it can complicate the review process and delay your license renewal.

Lastly, some individuals may underestimate the importance of documenting the total hours accurately. Miscalculating the hours can lead to significant issues, including penalties for failing to meet the required hours. It is advisable to keep meticulous records of your continuing education activities to ensure accuracy on the form.

By being mindful of these common pitfalls, licensees can ensure a smoother and more efficient renewal process for their CPA licenses. Taking the time to carefully complete the CPE Reporting form can save both time and stress in the long run.