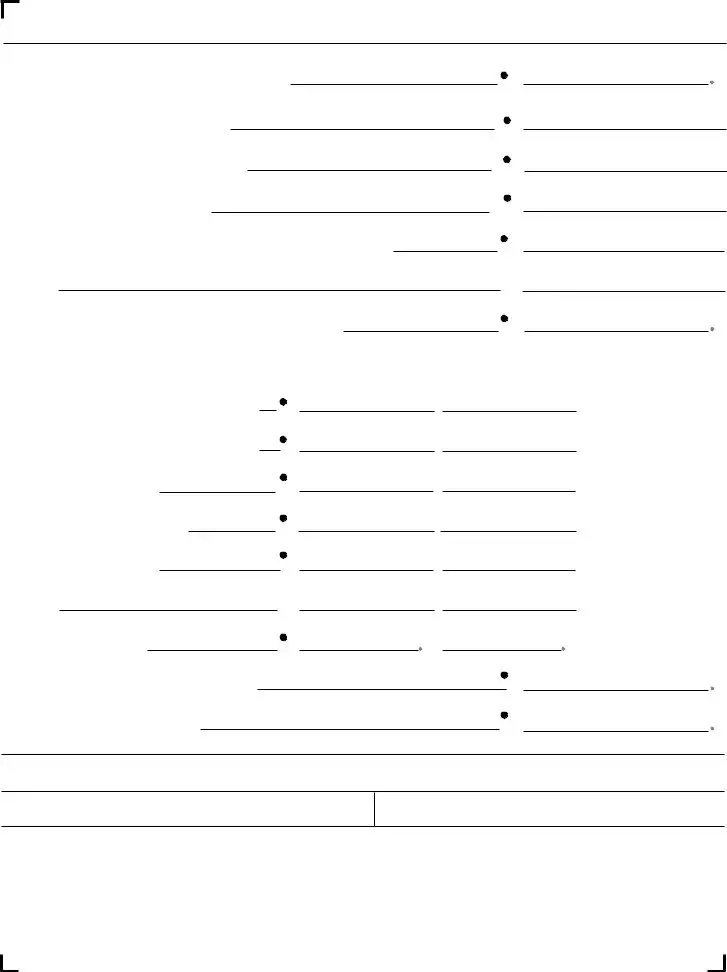

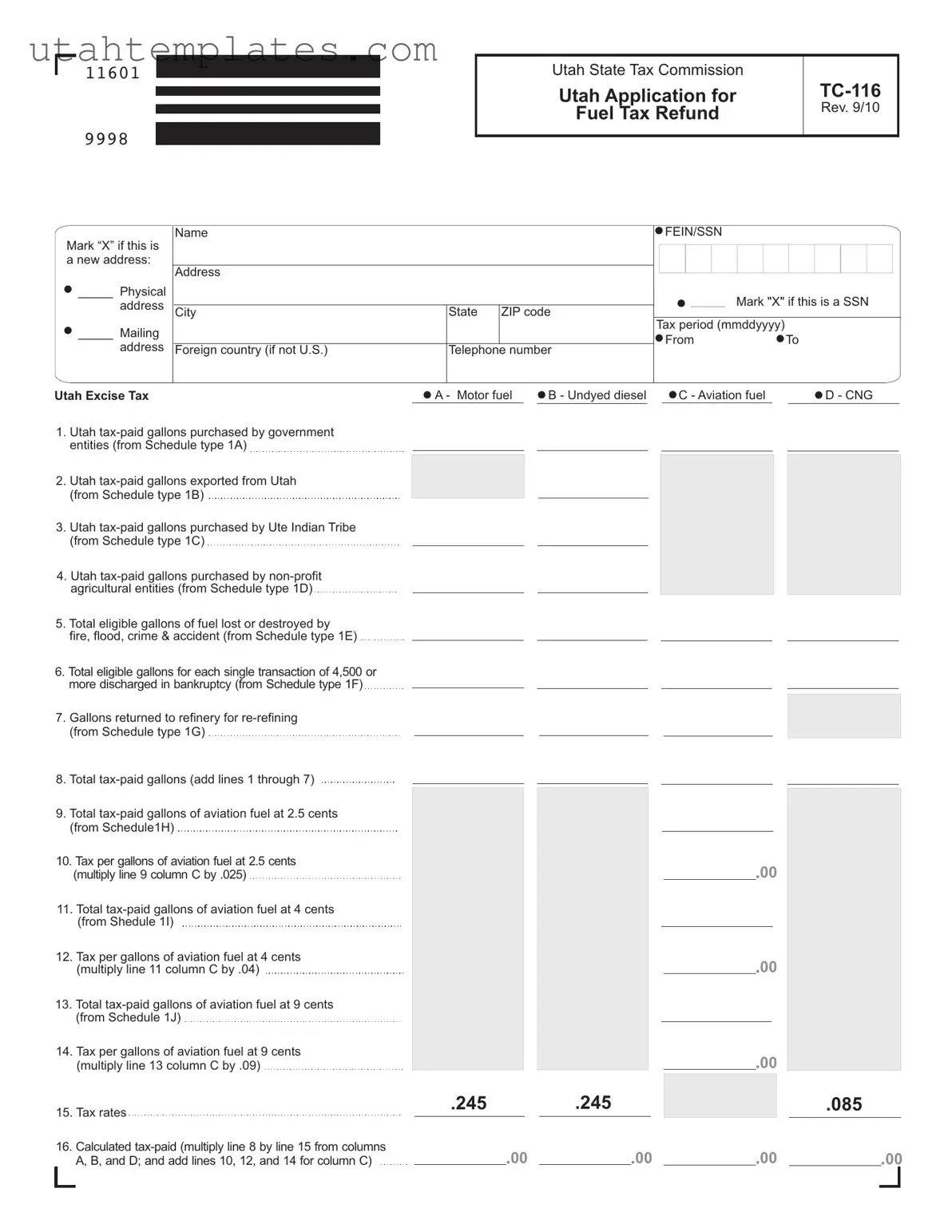

When filling out the Utah TC-116 form, many individuals make common mistakes that can delay their refund or even lead to rejection. One frequent error is failing to mark the box indicating a new address. If your address has changed and you neglect to update this information, it can cause significant issues with processing your application.

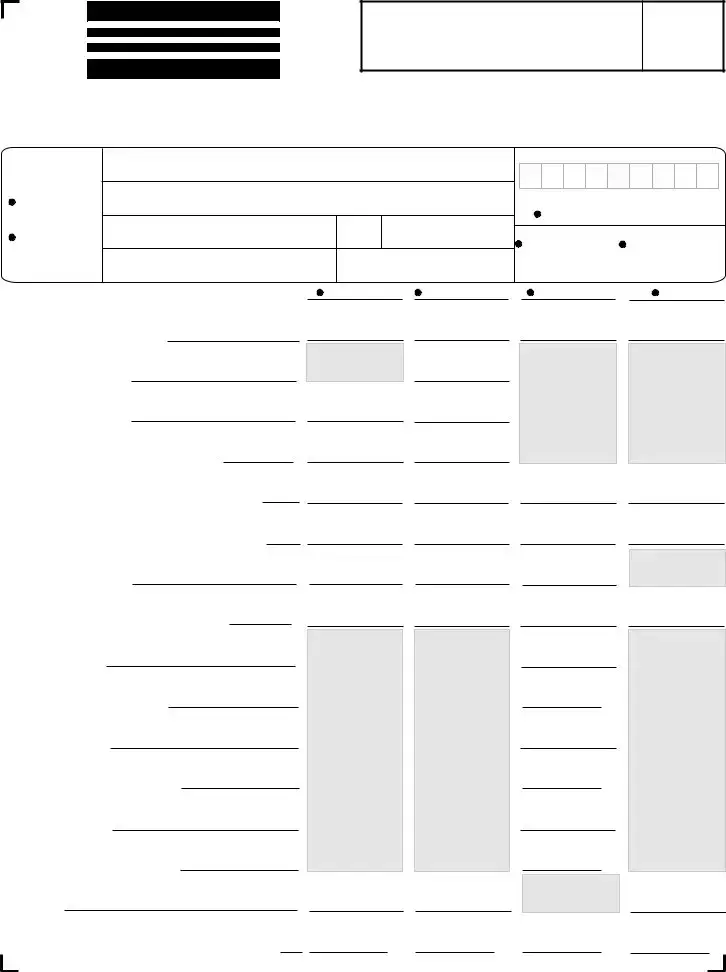

Another common mistake is omitting the Federal Employer Identification Number (FEIN) or Social Security Number (SSN). This information is crucial for identifying your application. Leaving it blank can result in your application being returned for correction.

Many people also miscalculate the total eligible gallons. It's essential to ensure that all gallons from the various schedules are accurately totaled. Errors in addition can lead to incorrect tax calculations, which may affect your refund amount.

Some applicants forget to include all relevant schedules. Each schedule provides critical information that supports your claim. Missing a schedule can create gaps in your application, making it incomplete.

Another mistake involves the tax period. Ensure that the dates entered for the tax period are correct and formatted properly. An incorrect date can lead to confusion and processing delays.

It's also important to double-check the calculations for the tax rates applied to the gallons. Misapplying rates or failing to calculate the total tax can significantly impact the refund amount. Review each line carefully to ensure accuracy.

Applicants sometimes overlook the certification statement at the end of the form. Failing to sign and date the application can result in immediate rejection. Always remember to certify that the information provided is true and complete.

Some individuals neglect to provide a contact number. Including a telephone number allows the tax commission to reach you if there are any questions regarding your application. This can expedite the process.

Lastly, be cautious about the mailing address. If you are submitting the form by mail, ensure that the address is correct and clearly written. A misplaced letter can lead to delays or loss of your application.

By avoiding these common mistakes, you can help ensure that your Utah TC-116 form is processed smoothly and efficiently.

FEIN/SSN

FEIN/SSN 00

00 00

00 00

00 00

00 00

00 00

00 00

00 00

00 00

00 00

00 00

00 00

00