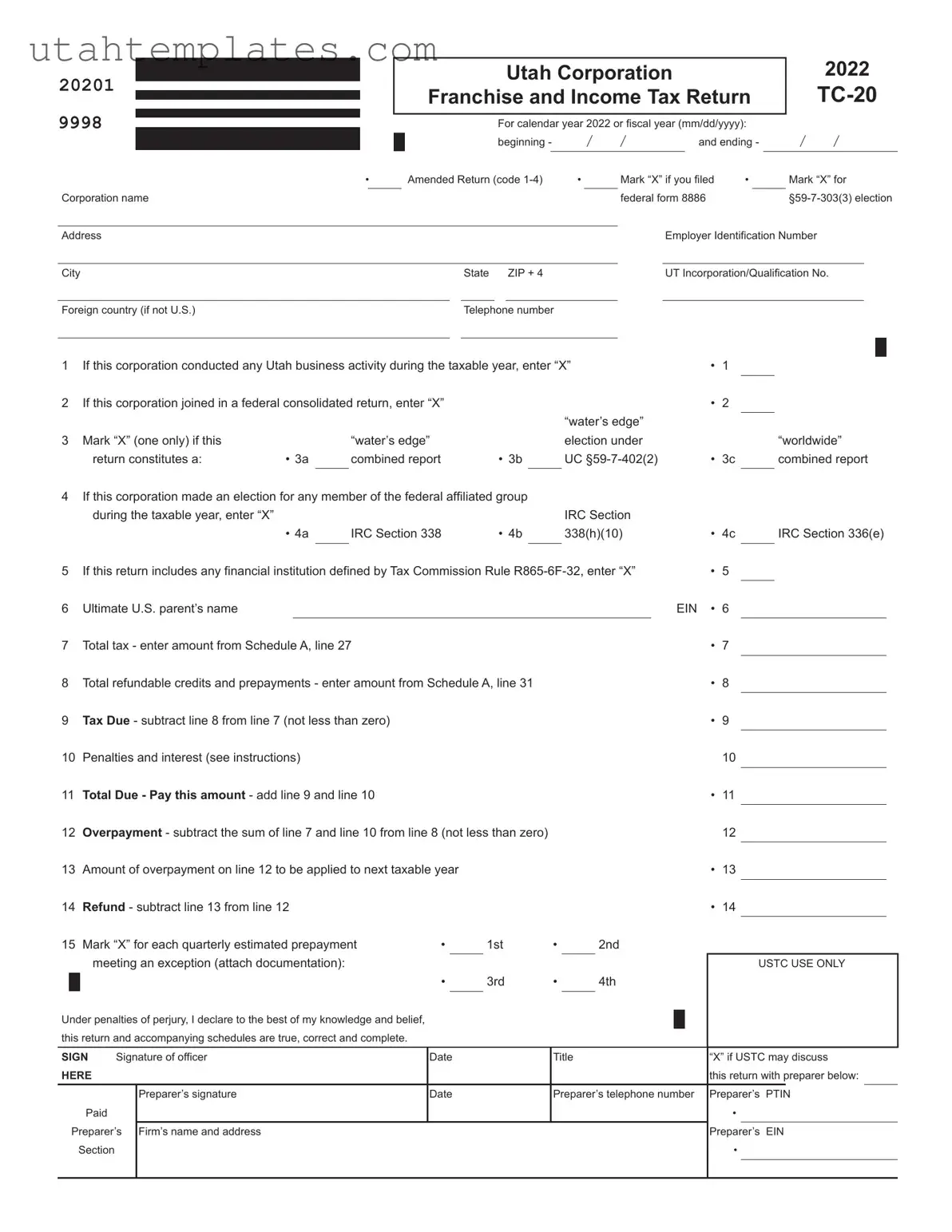

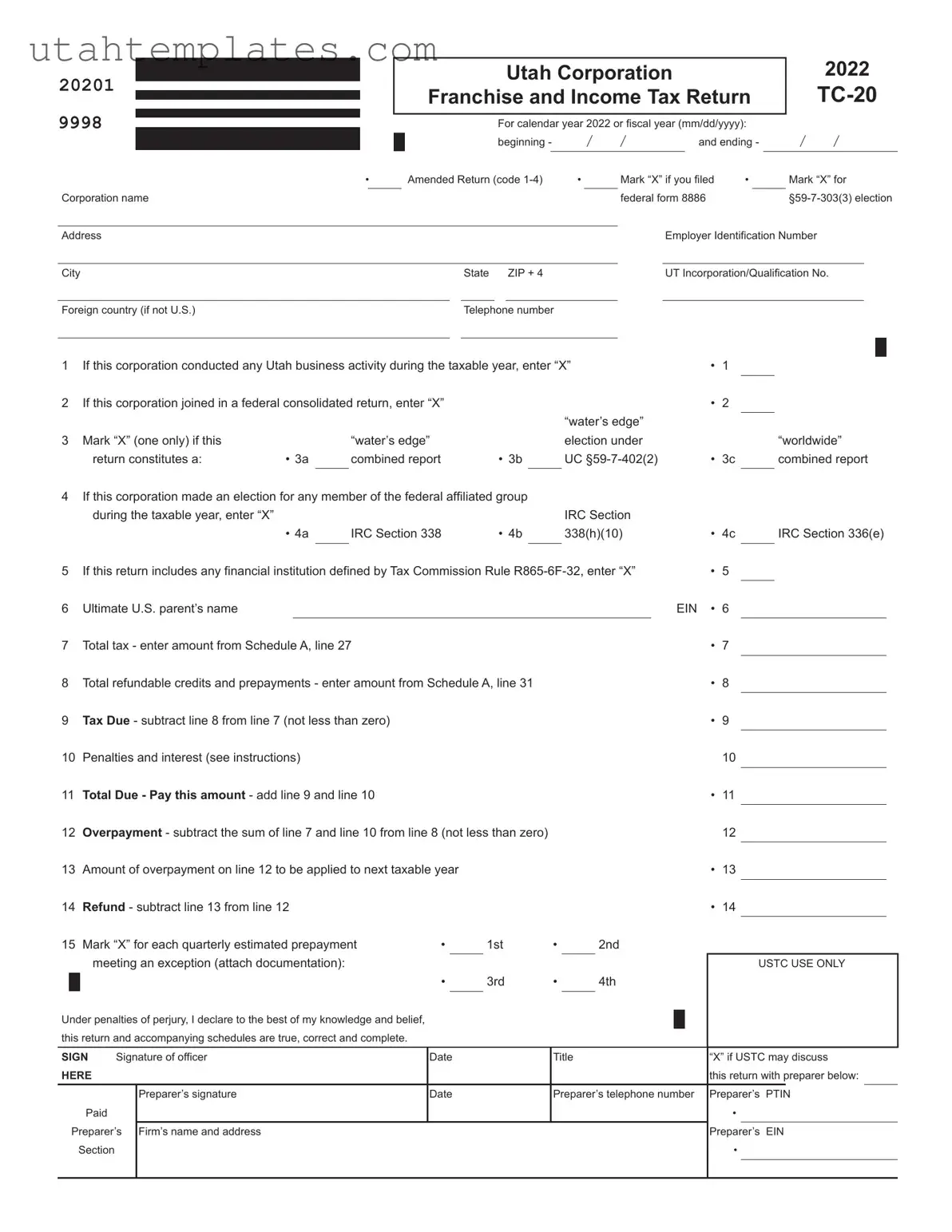

Blank Utah Tc 20 Form

The Utah TC-20 form is a crucial document for corporations operating in Utah, specifically designed for filing the state's Franchise and Income Tax Return. This form collects essential financial information and tax calculations for the tax year, ensuring compliance with state tax laws. Understanding its components and requirements can help corporations navigate their tax obligations more effectively.

Launch Utah Tc 20 Editor Here

Blank Utah Tc 20 Form

Launch Utah Tc 20 Editor Here

Need to check this off quickly?

Fill out Utah Tc 20 online without dealing with paper.

Launch Utah Tc 20 Editor Here

or

Free PDF File