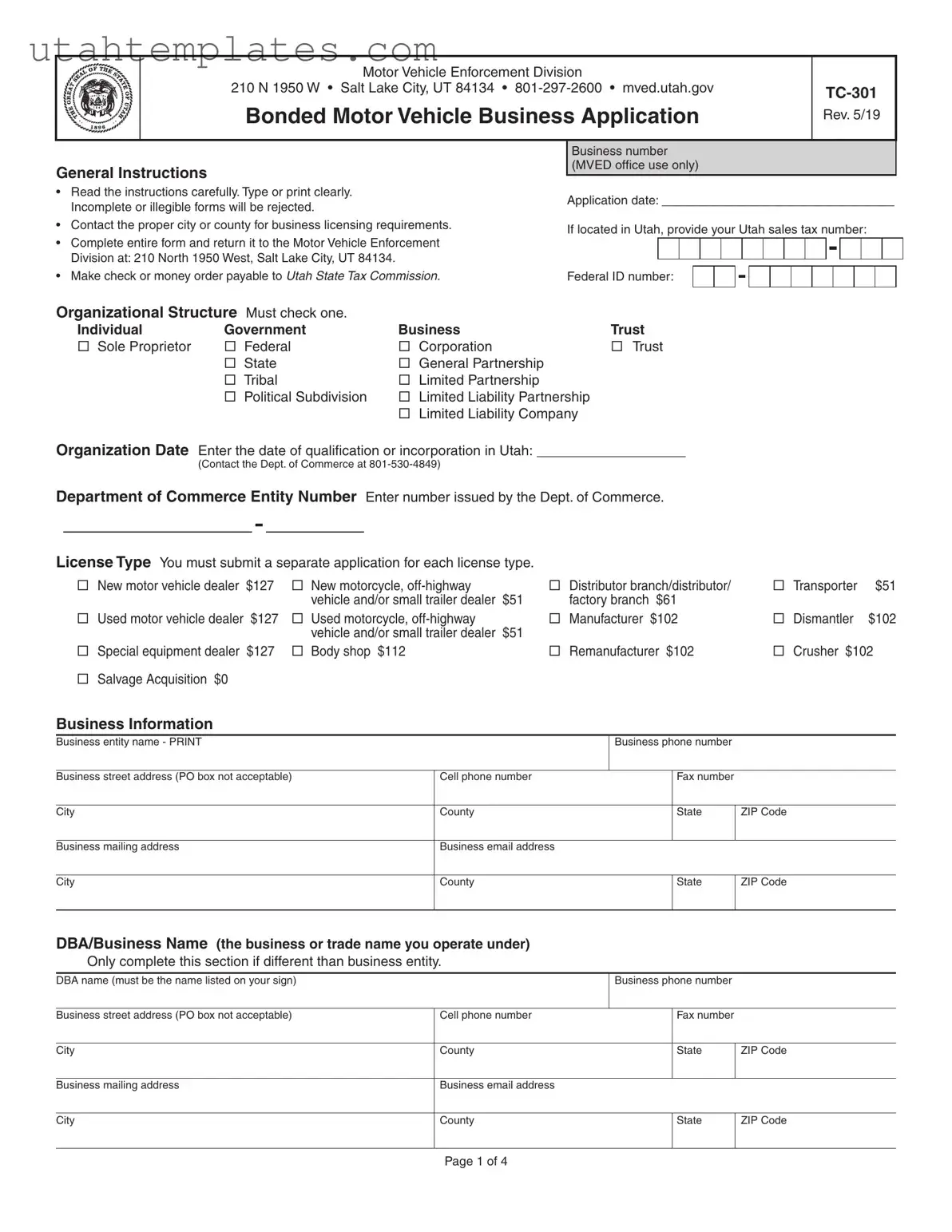

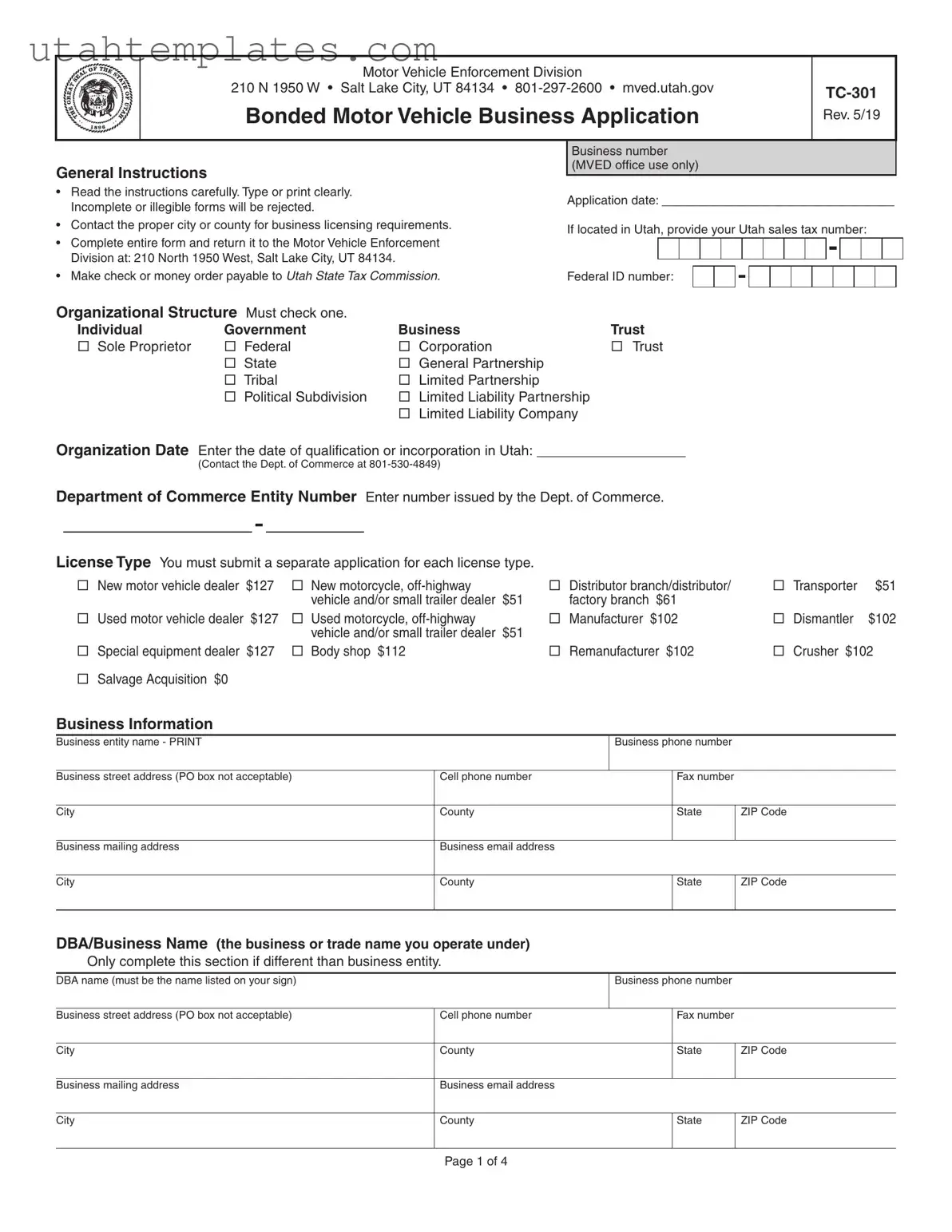

Completing the Utah TC-301 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or rejections. One frequent error is failing to read the instructions thoroughly. Each section of the form has specific requirements, and overlooking these can result in an incomplete application. It's essential to take the time to understand what is needed before starting.

Another common mistake is submitting an illegible form. Whether typed or printed, clarity is crucial. If the information cannot be read easily, the application may be rejected. Using clear handwriting or a good printer will help ensure that all details are visible and understandable.

Many applicants forget to include their Utah sales tax number if they are located in Utah. This piece of information is vital for processing the application. Omitting it can cause unnecessary delays, so it's wise to have this number handy when filling out the form.

When it comes to organizational structure, people often check the wrong box. The form requires you to indicate whether you are a sole proprietor, corporation, partnership, or another type of entity. Choosing the incorrect option can lead to complications down the line, so double-checking this section is essential.

Another mistake involves the business entity name. Applicants sometimes write a different name than what is officially registered. It's important to ensure that the name on the form matches exactly with what is listed with the Department of Commerce. This consistency helps avoid confusion and potential legal issues.

In addition, applicants frequently overlook the requirement to disclose their employment history. Listing at least five years of employment history for each owner is necessary. Failing to do so can lead to questions about the applicant's qualifications and may delay the approval process.

Some individuals also neglect to provide complete information about any past legal issues. The form asks about misdemeanors or felonies, and not disclosing this information can result in serious consequences. Honesty is crucial here; if there are any charges, they should be included to avoid complications later.

Another common oversight is not signing the application. All owners must sign the form, and missing signatures can lead to automatic rejection. It's a simple step, but it is often forgotten in the rush to submit the application.

Additionally, applicants sometimes fail to include the necessary fees or submit the correct payment method. The form specifies how much is owed depending on the type of license being applied for. Ensuring that the correct amount is sent will help avoid processing delays.

Finally, many applicants do not provide a current copy of their plate insurance declaration when ordering or renewing plates. This documentation is essential and must be issued in the name of the licensed business. Without it, the application may not be processed, causing frustration and delays.