|

|

|

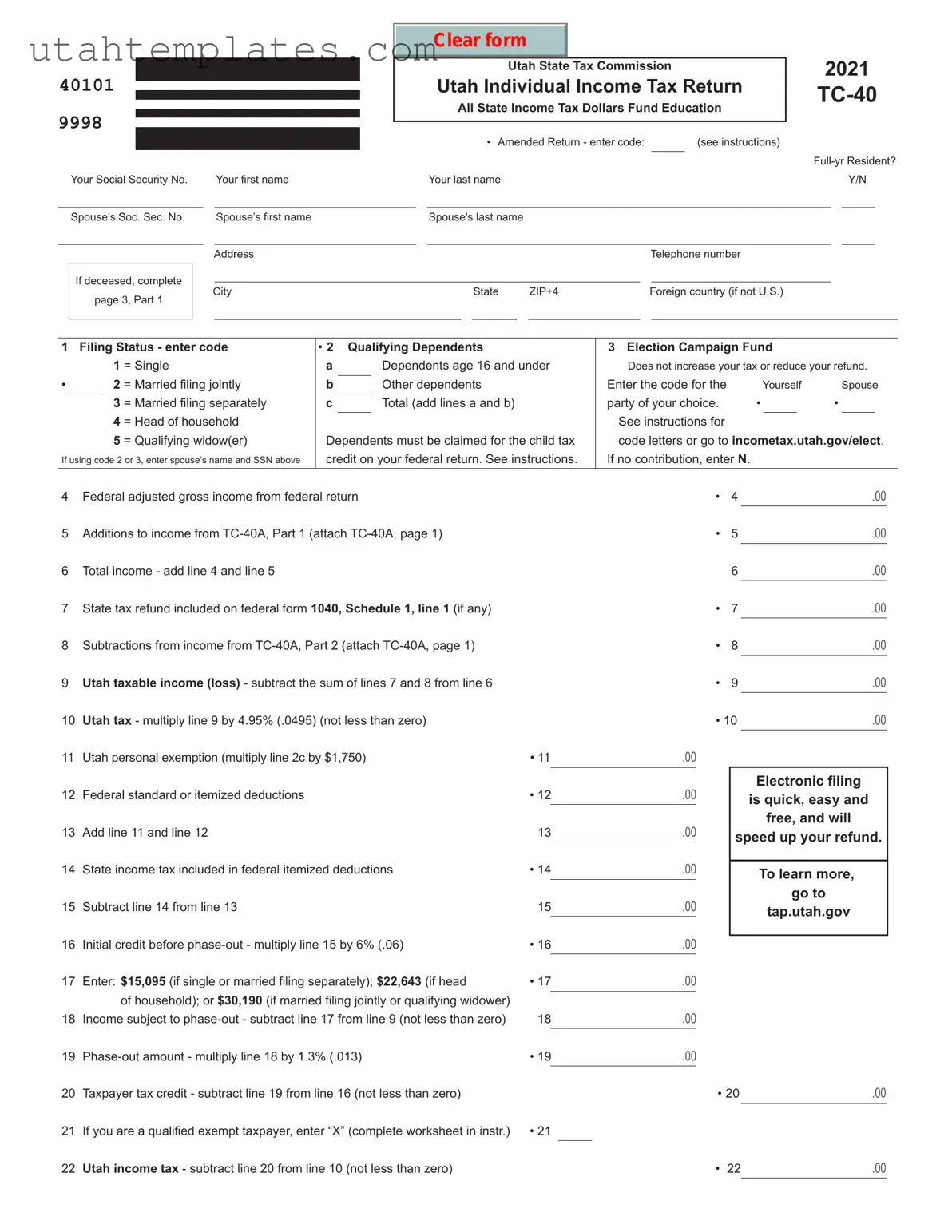

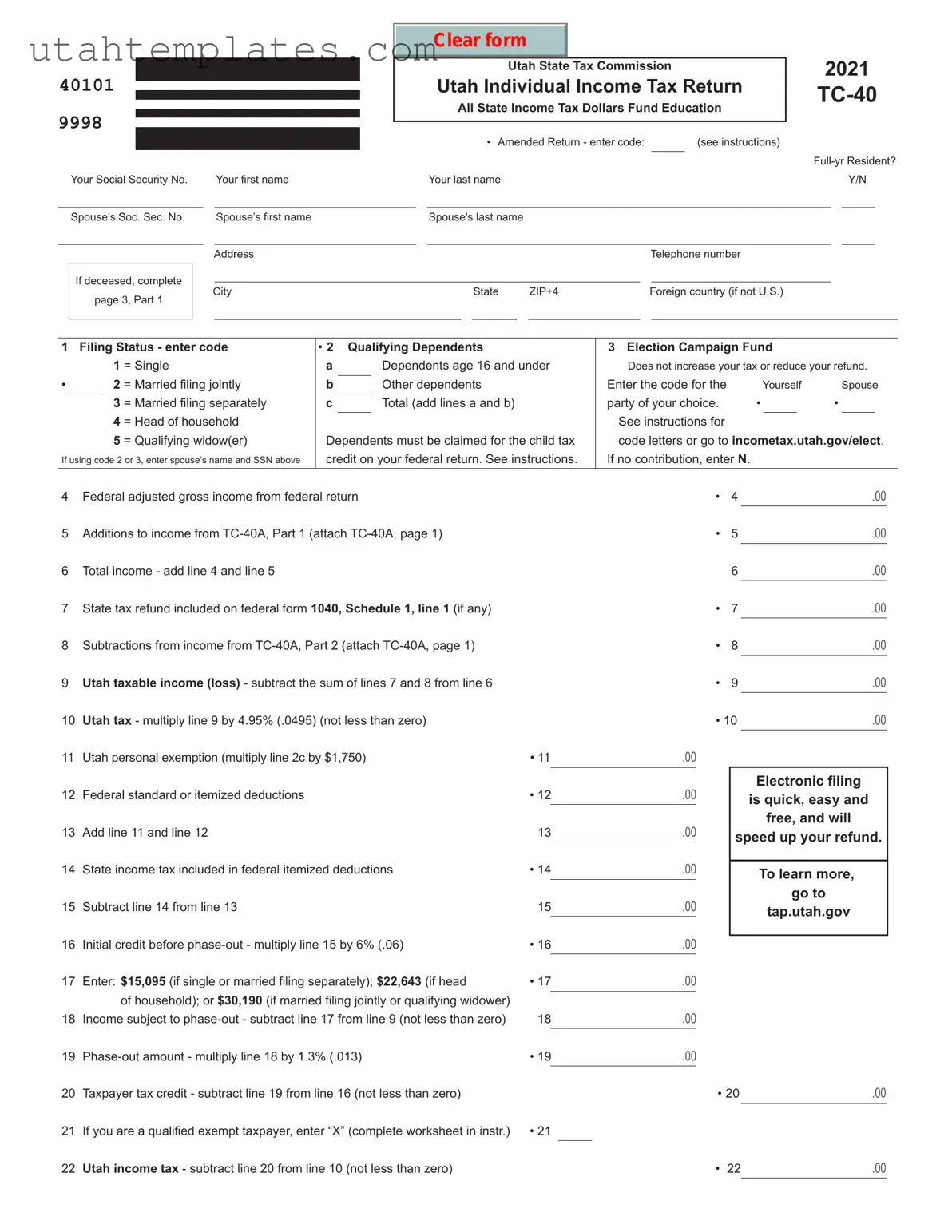

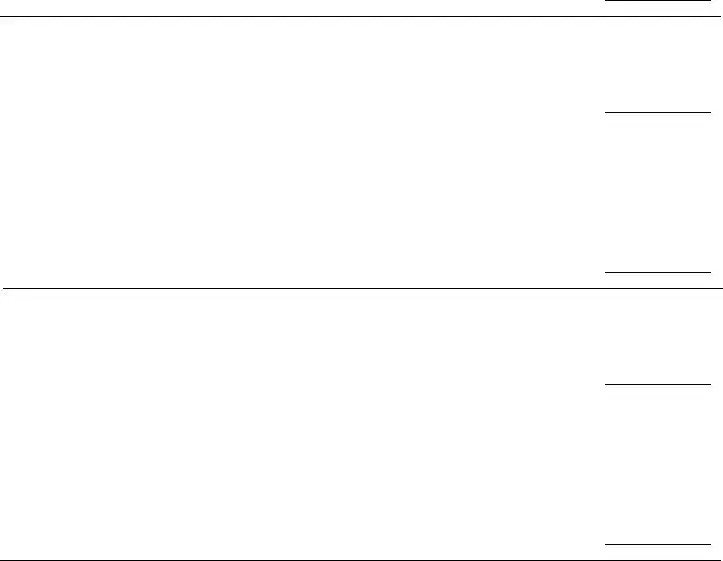

Non and Part-year Resident Schedule |

|

|

|

|

|

|

|

|

|

|

|

TC-40B |

|

|

|

|

40106 |

SSN |

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

/ |

/ |

|

|

Residency Status: • |

|

Nonresident: Home state abbreviation: |

• |

Part-year resident from: |

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mm/dd/yy |

|

|

|

|

mm/dd/yy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Col. A - UTAH |

|

|

|

|

Col. B - TOTAL |

|

1 |

Wages, salaries, tips, etc. (1040 line 1) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

2 |

Taxable interest income (1040 line 2b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

3 |

Ordinary dividends (1040 line 3b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

4 |

IRAs, pensions and annuities - taxable amount (1040 lines 4b and 5b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

5 |

Social Security benefits - taxable amount (1040 line 6b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

6 |

Taxable refunds/credits/offsets of state/local income taxes (1040, Schedule 1, line 1) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

7 |

Alimony received (1040, Schedule 1, line 2a) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

8 |

Business income or (loss) (1040, Schedule 1, line 3) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

9 |

Capital gain or (loss) (1040, line 7) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

10 |

Other gains or (losses) (1040, Schedule 1, line 4) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

11 |

Rental real estate, royalties, partnerships, S corps, trusts, etc. (1040, Schd 1, line 5) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

12 |

Farm income or (loss) (1040, Schedule 1, line 6) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

13 |

Unemployment compensation (1040, Schedule 1, line 7) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

14 |

Other income (1040, Schedule 1, line 9) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

15 |

Additions to income from TC-40A, Part 1 (Utah portion only in Utah column) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

16 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

17 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

18 |

Total income (loss) - add lines 1 through 17 for both columns A and B |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Col. A - UTAH |

|

|

|

|

Col. B - TOTAL |

|

19 |

Educator expenses (1040, Schedule 1, line 11) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

20 |

Certain bus. expenses of reservists, performing artists, etc. (1040, Schd 1, line 12) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

21 |

Health savings account deduction (1040, Schedule 1, line 13) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

22 |

Moving expenses (1040, Schedule 1, line 14) - col. A only expenses moving into Utah |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

23 |

Deductible part of self-employment tax (1040, Schedule 1, line 15) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

24 |

Self-employed SEP, SIMPLE and qualified plans (1040, Schedule 1, line 16) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

25 |

Self-employed health insurance deduction (1040, Schedule 1, line 17) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

26 |

Penalty on early withdrawal of savings (1040, Schedule 1, line 18) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

27 |

Alimony paid (1040, Schedule 1, line 19a) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

28 |

IRA deduction (1040, Schedule 1, line 20) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

29 |

Student loan interest deduction (1040, Schedule 1, line 21) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

30 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

31 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

32 |

Taxable refunds/credits/offsets of state and local income taxes (1040, Schd 1, line 1) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

33 |

Subtractions from income from TC-40A, Part 2 (Utah portion only in Utah column) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

34 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

35 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

36 |

(see instructions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

37 |

Total adjustments - add lines 19 through 36 for both columns A and B |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

Subtract line 37 from line 18 for both columns A and B |

|

|

|

• |

.00 |

|

• |

|

|

|

|

|

.00 |

|

|

|

|

Line 38, column B must equal TC-40, line 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non or Part-year Resident Utah Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

Divide line 38 column A by line 38 column B (to 4 decimal places, not more than 1.0000 or less than 0.0000) |

|

39 |

|

|

|

|

|

|

|

|

|

40 |

Subtract TC-40, line 24 from TC-40, line 23 and enter the result (not less than zero) here |

|

|

|

40 |

|

|

|

|

|

|

.00 |

|

|

41 |

UTAH TAX - Multiply line 40 by the decimal on line 39. Enter on TC-40, page 2, line 25 |

|

|

• |

41 |

|

|

|

|

|

|

.00 |

|

|

Submit this page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.