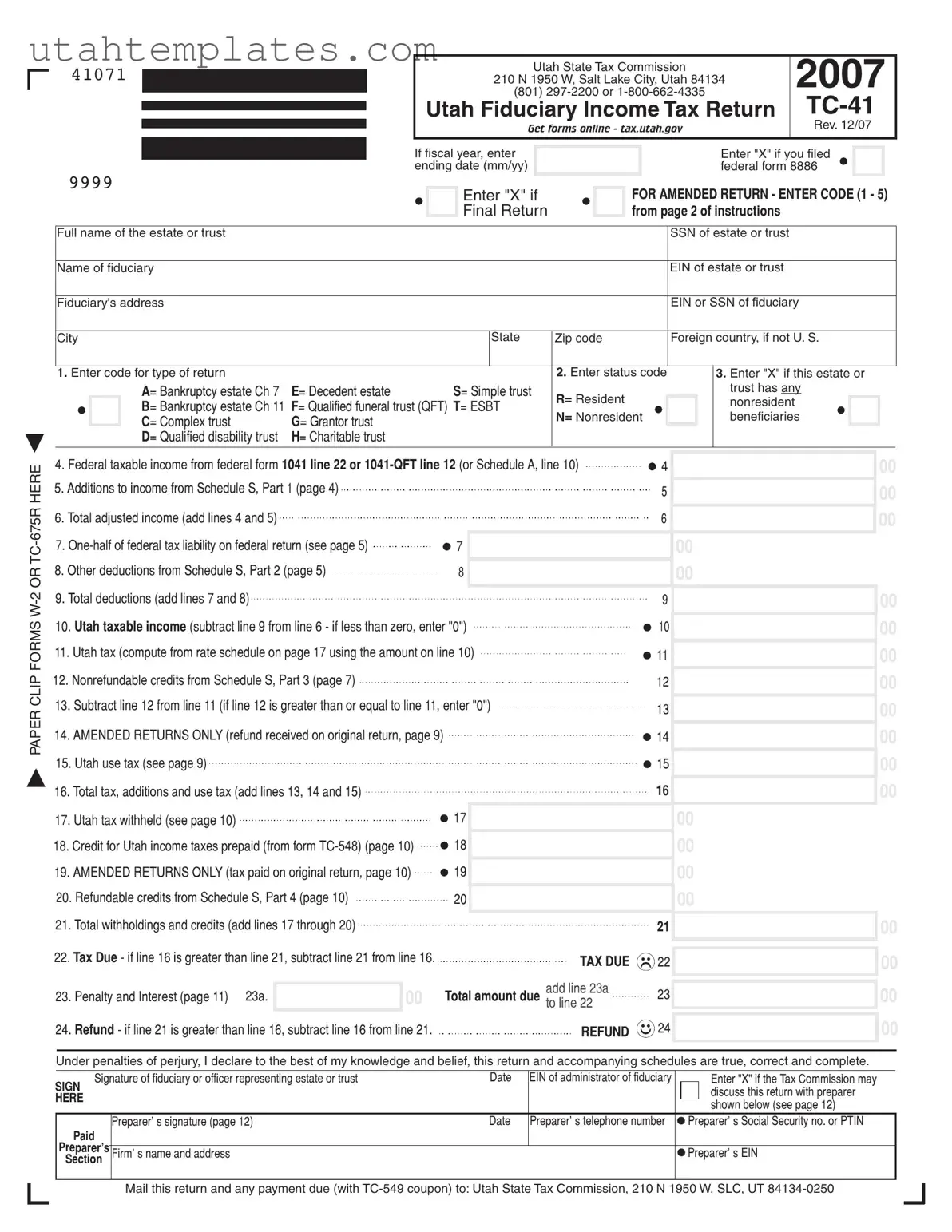

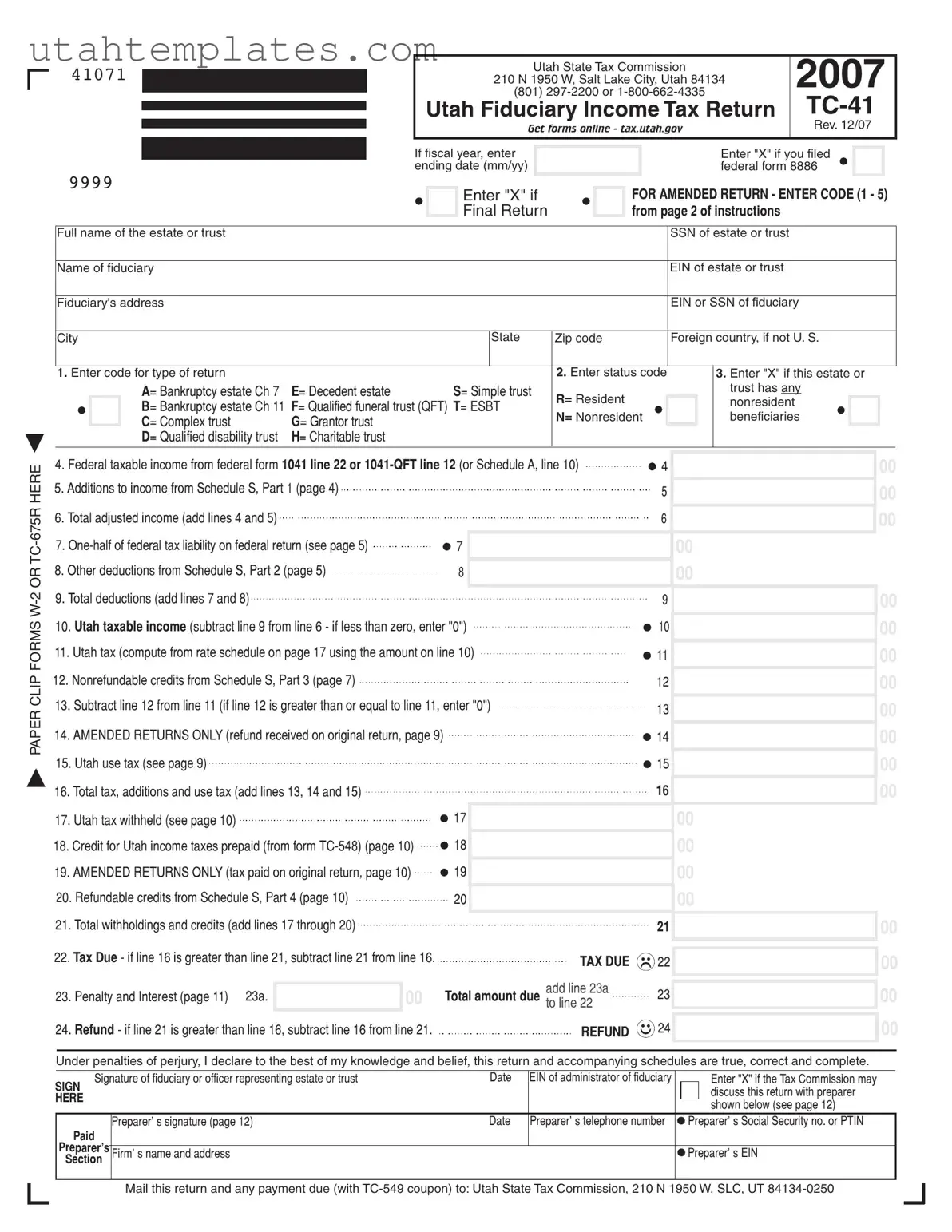

Completing the Utah TC-41 form can be a complex process, and mistakes can lead to delays or issues with tax filings. One common error occurs when individuals fail to provide the correct federal taxable income. This information must be accurately transferred from federal form 1041, line 22, or 1041-QFT, line 12. Omitting or misreporting this figure can significantly affect the calculations that follow.

Another frequent mistake is neglecting to check the appropriate boxes for the type of return being filed. The form includes various codes for different types of estates and trusts, such as bankruptcy estates or charitable trusts. Failing to mark the correct code can result in the form being processed incorrectly, potentially leading to unnecessary complications.

Many filers also overlook the requirement to attach necessary documents, such as Forms W-2 or TC-675R. These forms must be paper-clipped to the TC-41 to substantiate the income reported. Without these attachments, the tax commission may reject the return or request additional information, prolonging the process.

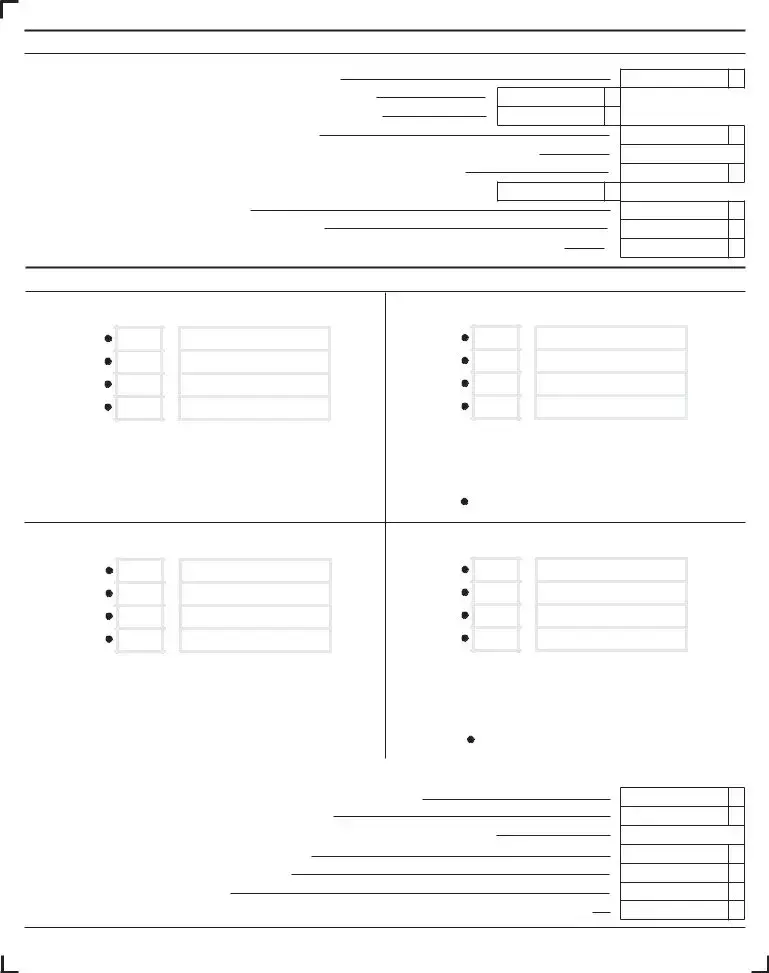

Inaccurate calculations are another common issue. Individuals may miscalculate total adjusted income by incorrectly adding or subtracting figures from previous lines. It is essential to double-check all arithmetic to ensure that the final amounts are correct. Mistakes in calculations can lead to incorrect tax due or refunds, which can complicate future filings.

Furthermore, some people forget to include their signature and date on the form. This step is crucial, as the tax commission requires a signed declaration affirming the accuracy of the information provided. An unsigned form will be considered incomplete and may delay processing.

Another common oversight is failing to enter the Employer Identification Number (EIN) or Social Security Number (SSN) of the fiduciary. This identification is necessary for the tax commission to process the return correctly. Incomplete identification can lead to complications in tracking the return and any associated payments.

When it comes to claiming credits, some filers may not fully understand the requirements for nonrefundable and refundable credits. Misreporting these credits can lead to discrepancies in the final tax amount owed or refunded. It is important to carefully review the instructions and ensure all applicable credits are claimed accurately.

Lastly, individuals sometimes neglect to keep copies of their completed forms and any supporting documentation. Maintaining records of submitted forms is essential for future reference and in case of audits or inquiries from the tax commission. Keeping a well-organized file can save time and stress later on.