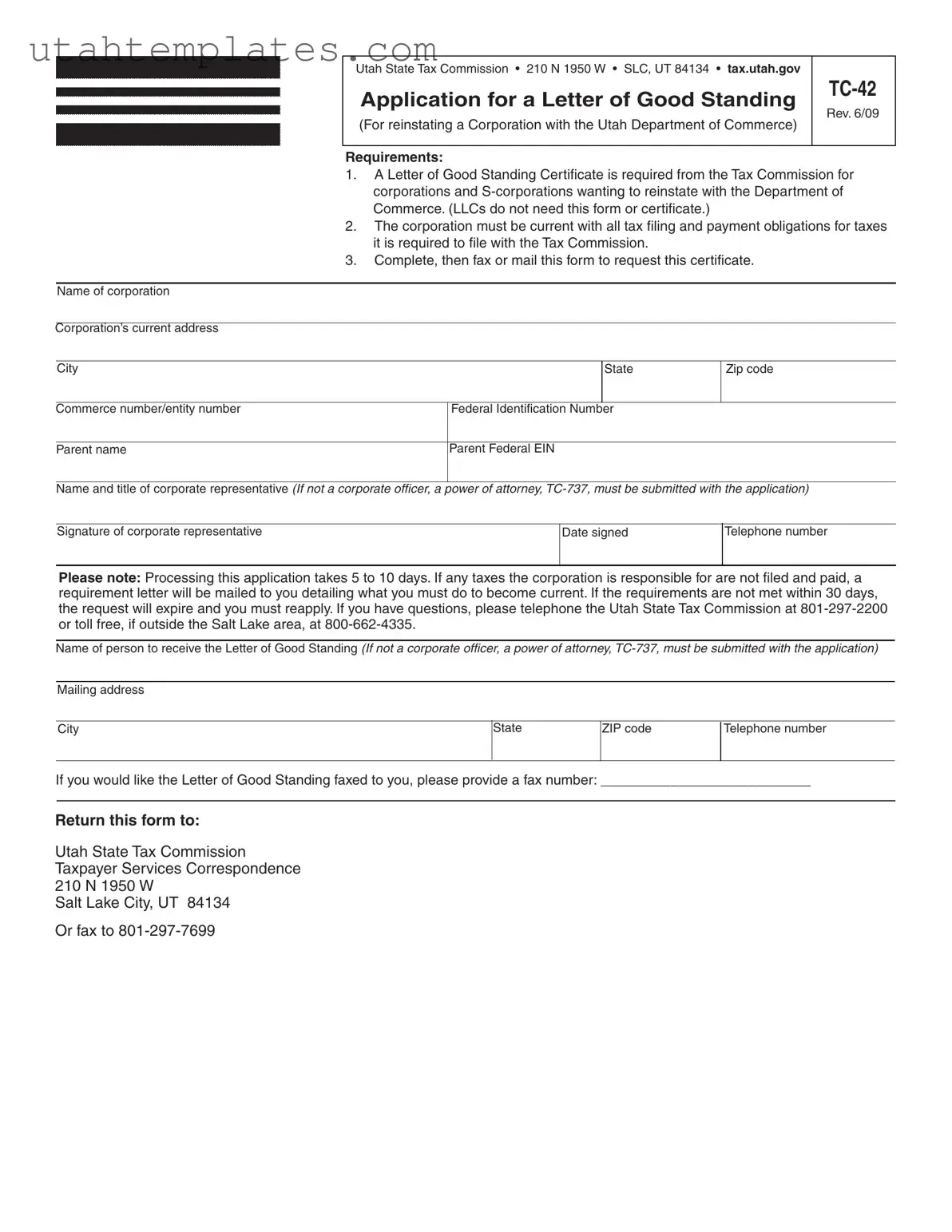

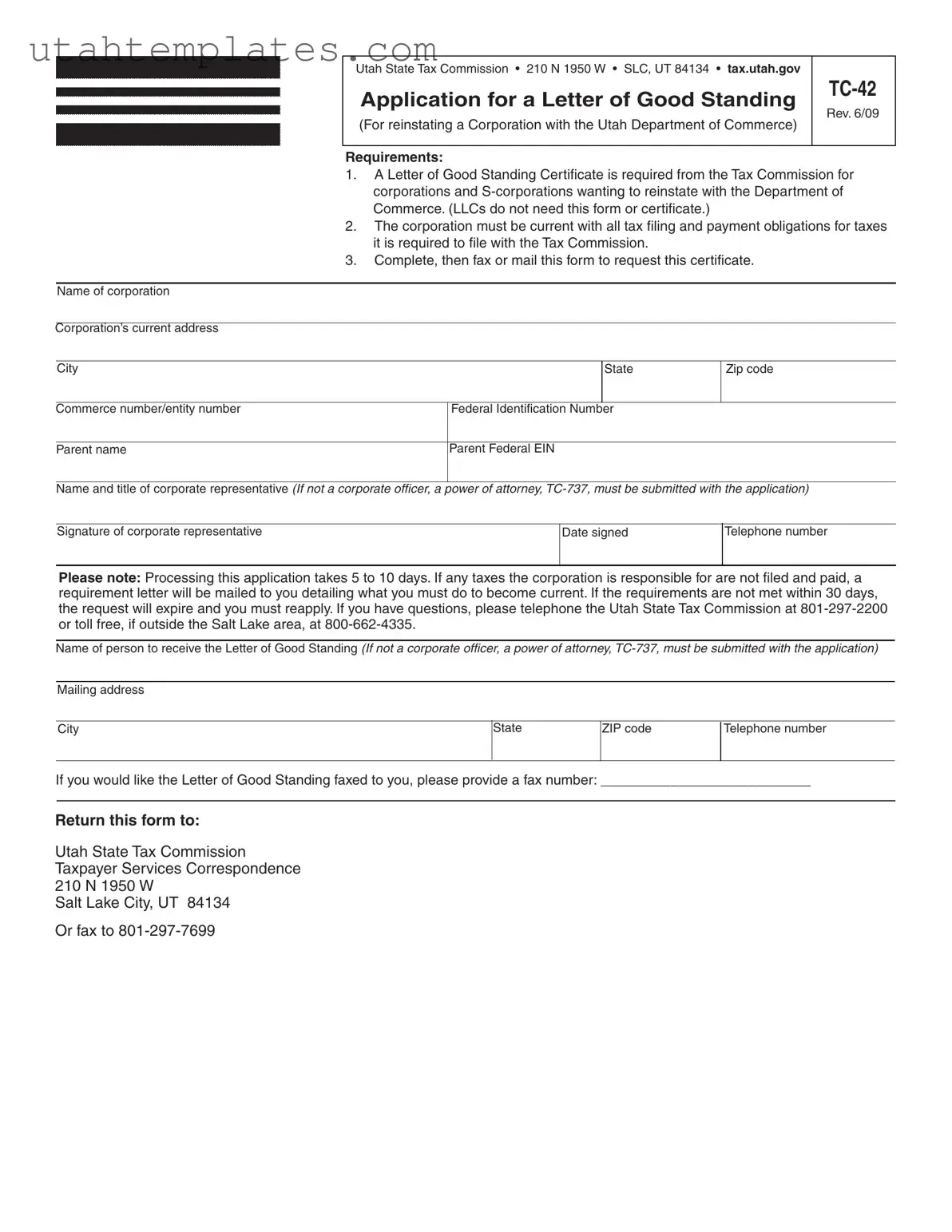

When filling out the Utah TC-42 form, many people make common mistakes that can delay the process. One frequent error is failing to provide the correct corporation name. Ensure that the name matches exactly with what is registered with the Utah Department of Commerce. An incorrect name can lead to confusion and potential rejection of the application.

Another mistake involves the corporation's address. It's essential to include the current and complete address, including the city, state, and ZIP code. Omitting any part of this information can result in processing delays or miscommunication.

Many applicants forget to include the Commerce number or entity number. This number is crucial for identifying the corporation in the state’s records. Without it, the Tax Commission may struggle to locate your corporation’s information, which could lead to unnecessary complications.

Another common oversight is not providing the Federal Identification Number. This number is vital for tax purposes and must be included accurately. Missing or incorrect information here can cause significant delays in processing your request.

Many individuals also neglect to sign the form. The signature of the corporate representative is mandatory. Without it, the application will not be considered complete, and you may have to start over.

In addition, some applicants fail to indicate the name of the person who should receive the Letter of Good Standing. If this information is missing, the Tax Commission may not know where to send the certificate, leading to further delays.

Another mistake is providing an incomplete mailing address for the recipient. Just like with the corporation's address, every part of the mailing address must be accurate and complete to ensure proper delivery.

Applicants sometimes overlook the need to provide a fax number if they wish to receive the Letter of Good Standing via fax. Without this information, the Tax Commission will send the letter by mail, which may take longer.

Finally, some people fail to check their tax filing status before applying. If the corporation is not current with all tax obligations, the application may be rejected, and a requirement letter will be sent detailing what needs to be done. This can lead to frustration and additional delays in obtaining the Letter of Good Standing.