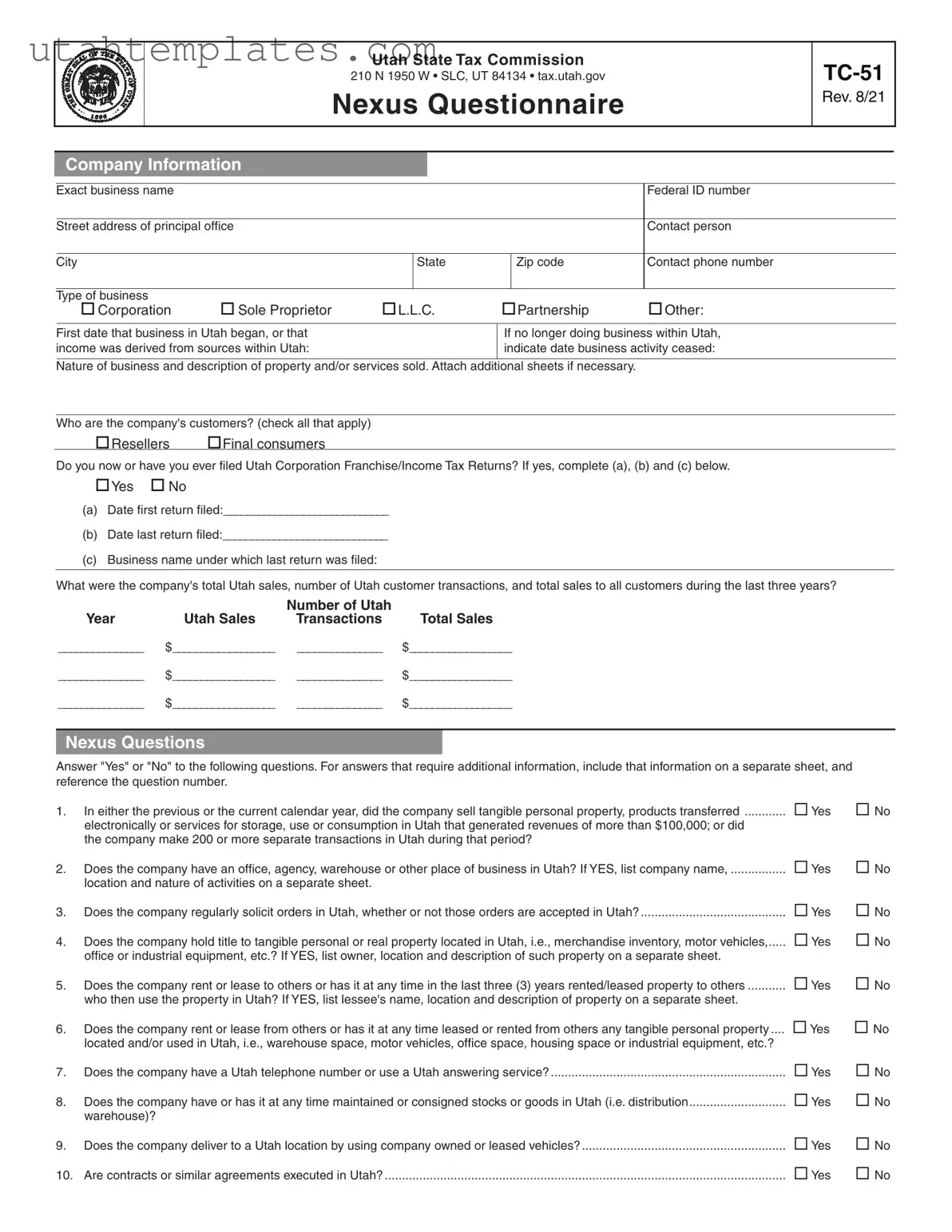

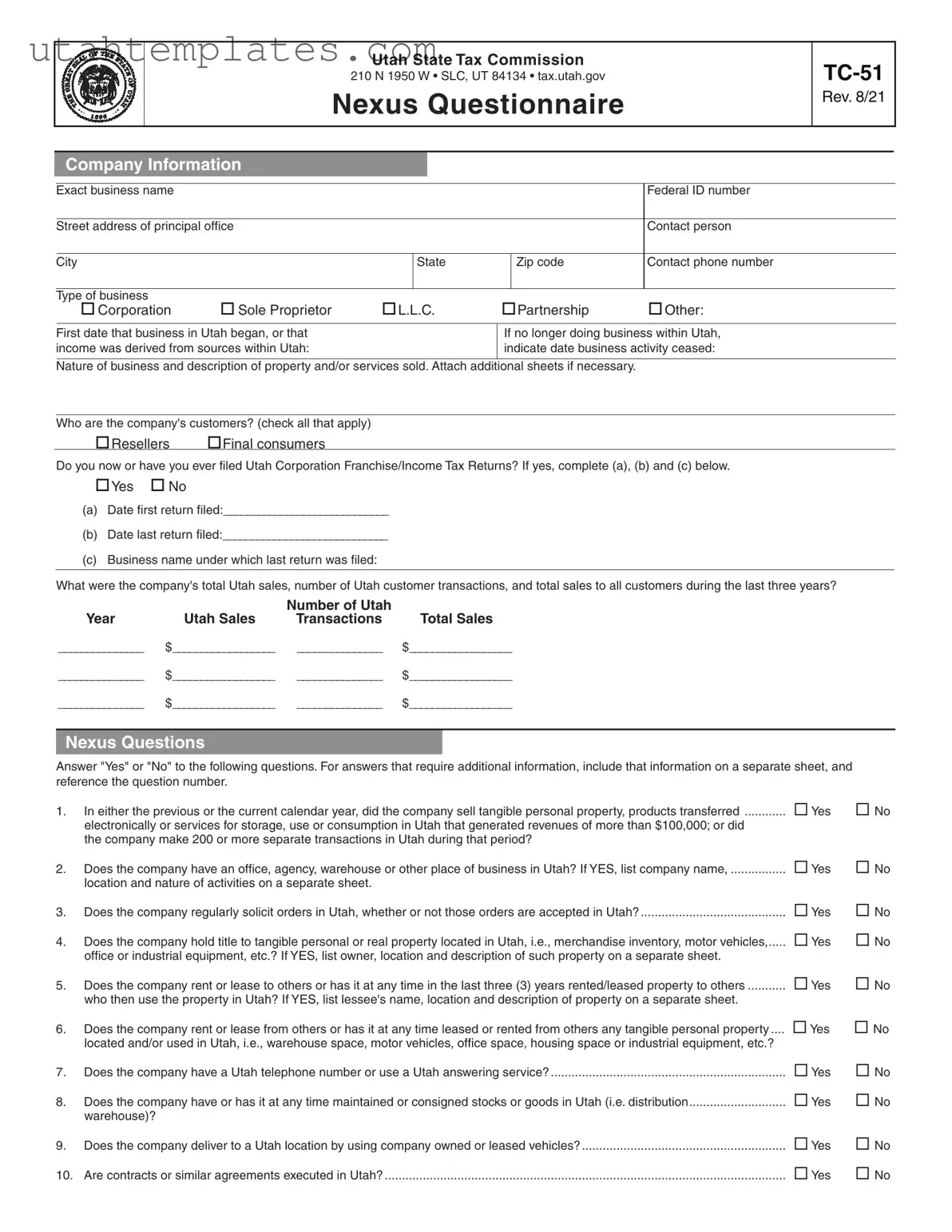

Utah State Tax Commission

210 N 1950 W • SLC, UT 84134 • tax.utah.gov

Nexus Questionnaire

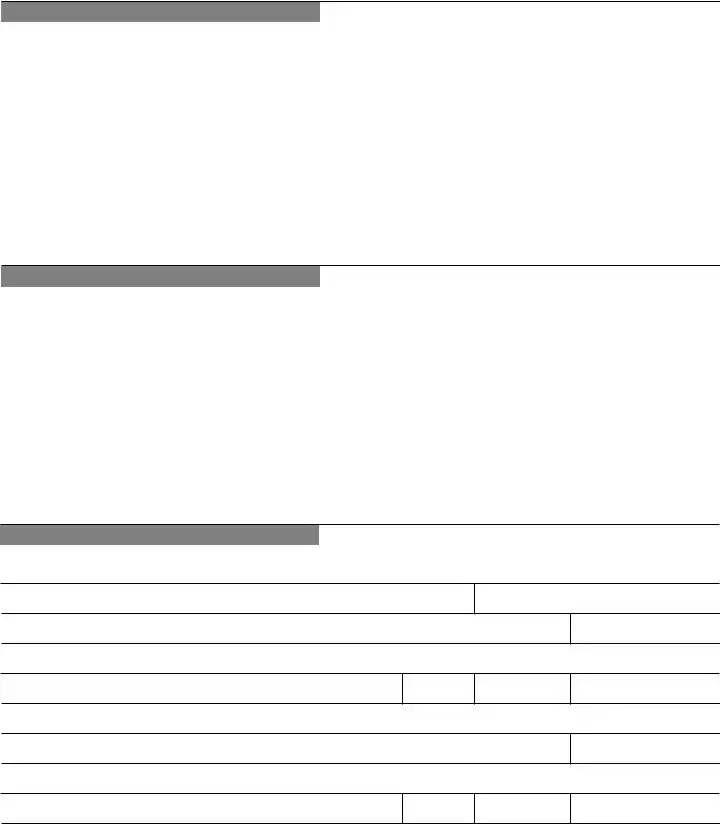

Company Information

Exact business name

Street address of principal office

Federal ID number

Contact person

Type of business |

|

|

|

|

Corporation |

Sole Proprietor |

L.L.C. |

Partnership |

Other: |

First date that business in Utah began, or that income was derived from sources within Utah:

If no longer doing business within Utah, indicate date business activity ceased:

Nature of business and description of property and/or services sold. Attach additional sheets if necessary.

Who are the company's customers? (check all that apply)

Resellers Final consumers

Do you now or have you ever filed Utah Corporation Franchise/Income Tax Returns? If yes, complete (a), (b) and (c) below.

Yes No

(a)Date first return filed:_____________________________

(b)Date last return filed:_____________________________

(c)Business name under which last return was filed:

What were the company's total Utah sales, number of Utah customer transactions, and total sales to all customers during the last three years?

|

|

Number of Utah |

|

Year |

Utah Sales |

Transactions |

Total Sales |

_______________ |

$__________________ |

_______________ |

$__________________ |

_______________ |

$__________________ |

_______________ |

$__________________ |

_______________ |

$__________________ |

_______________ |

$__________________ |

Nexus Questions

Answer "Yes" or "No" to the following questions. For answers that require additional information, include that information on a separate sheet, and reference the question number.

1. |

In either the previous or the current calendar year, did the company sell tangible personal property, products transferred |

Yes |

No |

|

electronically or services for storage, use or consumption in Utah that generated revenues of more than $100,000; or did |

|

|

|

the company make 200 or more separate transactions in Utah during that period? |

|

|

2. |

Does the company have an office, agency, warehouse or other place of business in Utah? If YES, list company name, ................ Yes |

No |

|

location and nature of activities on a separate sheet. |

|

|

3. |

Does the company regularly solicit orders in Utah, whether or not those orders are accepted in Utah? |

Yes |

No |

4. |

Does the company hold title to tangible personal or real property located in Utah, i.e., merchandise inventory, motor vehicles,..... Yes |

No |

|

office or industrial equipment, etc.? If YES, list owner, location and description of such property on a separate sheet. |

|

|

5. |

Does the company rent or lease to others or has it at any time in the last three (3) years rented/leased property to others |

Yes |

No |

|

who then use the property in Utah? If YES, list lessee's name, location and description of property on a separate sheet. |

|

|

6. |

Does the company rent or lease from others or has it at any time leased or rented from others any tangible personal property .... |

Yes |

No |

|

located and/or used in Utah, i.e., warehouse space, motor vehicles, office space, housing space or industrial equipment, etc.? |

|

|

7. |

Does the company have a Utah telephone number or use a Utah answering service? |

Yes |

No |

8. |

Does the company have or has it at any time maintained or consigned stocks or goods in Utah (i.e. distribution |

Yes |

No |

|

warehouse)? |

|

|

9. |

Does the company deliver to a Utah location by using company owned or leased vehicles? |

Yes |

No |

10. |

Are contracts or similar agreements executed in Utah? |

Yes |

No |

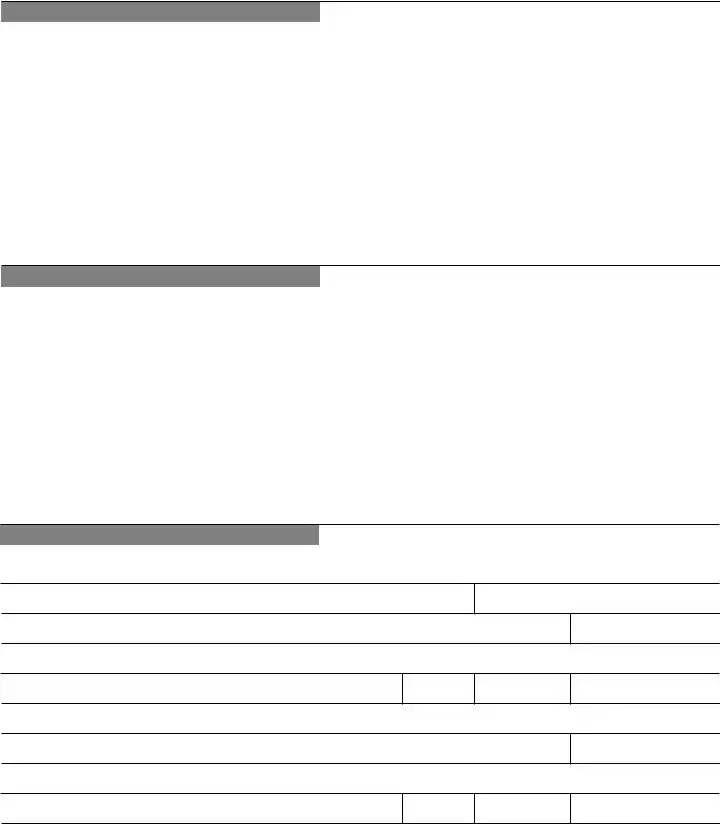

1. Repair shop .......................................................................................................................................................................

2. Parts department...............................................................................................................................................................

3. Any kind of office other than an in-home office .................................................................................................................

4. Warehouse ........................................................................................................................................................................

5. Meeting place for directors, officers or employees ............................................................................................................

6. Stock of goods...................................................................................................................................................................

7. Telephone answering service ............................................................................................................................................

8. Mobile stores, i.e., trucks with driver salesmen .................................................................................................................

9. Real property or fixtures of any kind .................................................................................................................................

q. Consigning tangible personal property to any person, including an independent contractor ............................................

r. Maintaining, by either an in-state or an out-of-state resident employee, an office or place of business of any.................

kind other than an in-home office

s. Entering into franchising or licensing agreements.....................................................................................................................

15. Does the company have a standard form or written agreement with employees, sales representatives, commissioned .................

agents or independent contractors? If YES, enclose a sample copy.

16. Are commissioned agents/independent contractors forbidden (by contractual agreement or otherwise) from selling or..................

promoting your competitors' products?

Handling customer complaints ..................................................................................................................................................

Approving or accepting orders ..................................................................................................................................................

Repossessing property .............................................................................................................................................................

Securing deposits on sales .......................................................................................................................................................

Picking up or replacing damaged or returned property.............................................................................................................

Hiring, training or supervising personnel, other than personnel involved only in solicitation.....................................................

Using agency stock checks or any other instrument by which sales are made within Utah by sales personnel .......................

Maintaining sample or display room in excess of two weeks (14 days) during the year ...........................................................

Carrying samples for sale, exchange or distribution in any manner for consideration or other value .......................................

Owning, leasing, maintaining or otherwise using any of the following facilities or property in state of Utah

g.

h.

i.

j.

k.

l.

m.

n.

o.

p.

Providing any kind of technical assistance or service when a purpose of that assistance or service is something..................

other than the facilitation or solicitation of orders

Conducting training courses, seminars or lectures ...................................................................................................................

Installing or supervision of installation.......................................................................................................................................

Investigating credit worthiness ..................................................................................................................................................

Collecting current or delinquent accounts .................................................................................................................................

Making repairs or providing maintenance .................................................................................................................................

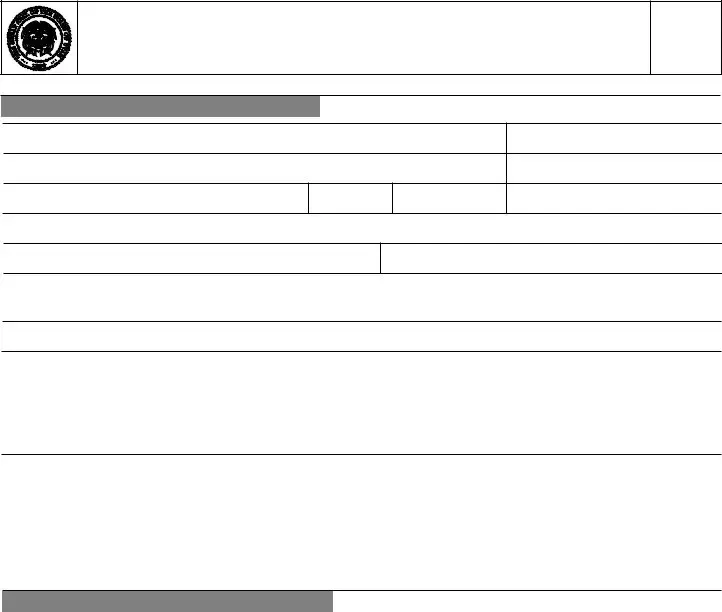

The following questions pertain to the type of activities performed by the employees or independent contract agent(s) within Utah.

14. Does the company have any employees, sales representatives, commission agents or independent contractors that carry out or that are responsible for any of the following activities in Utah?

a.

b.

c.

d.

e.

f.

11. Does the company engage in any activity in connection with the leasing or servicing of property located in Utah? ........................

12. Does the company have or has it ever had a security interest in any real or personal property sold or located in Utah? ................

13. Does the company have any employees, commissioned agents, independent contractors or other representatives.......................

residing, selling, soliciting or performing services in Utah? If YES, list on a separate sheet the year(s) in which your

employees or other representatives began performance of these activities in Utah.

Employee and Contract Agent Information

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

17.List names and addresses of employees or representatives, the territory they cover, and designate whether they are employees or independent contractors. Use additional sheets if necessary.

18. Do any of the sales agents in Utah represent your corporation only? |

Yes |

No |

Other Information

19. List the company's three (3) major Utah customers:

20. Are there other types of activities in Utah? Please explain:

SST Voluntary Seller

You are a voluntary seller in Utah under the Streamlined Sales Tax Agreement (see Article IV of SSUTA) if you have met ALL of the following conditions for at least 12 MONTHS PRIOR to registering with Utah:

1.You have had no fixed place of business in Utah for more than 30 days.

2.Less than $50,000 of your property* in located in Utah.

3.Less than $50,000 of your payroll occurs in Utah.

4.Less than 25 percent of your total property* or total payroll*are in Utah.

5.You do not collect sales or use tax in Utah as a condition for you or an affiliate to qualify as a supplier of goods or services to Utah.

6.You are not required to register and collect sales or use tax in Utah as a statutory requirement for yourself or an affiliate to be able to sell, ship or deliver a particular type of product into Utah.

*As defined in the contract between Streamlined Sales Tax Governing Board, Inc and the contractor.

21. Based on the criteria above, are you a voluntary Streamlined Sales Tax seller? |

Yes |

No |

Signatures

Under penalties of perjury, I declare that the information furnished in this questionnaire is, to the best of my knowledge and belief, true, correct and complete. If prepared by a person other than an officer of this corporation, this declaration is based on all information of which you have knowledge.

Officer's mailing address

Preparer's mailing address