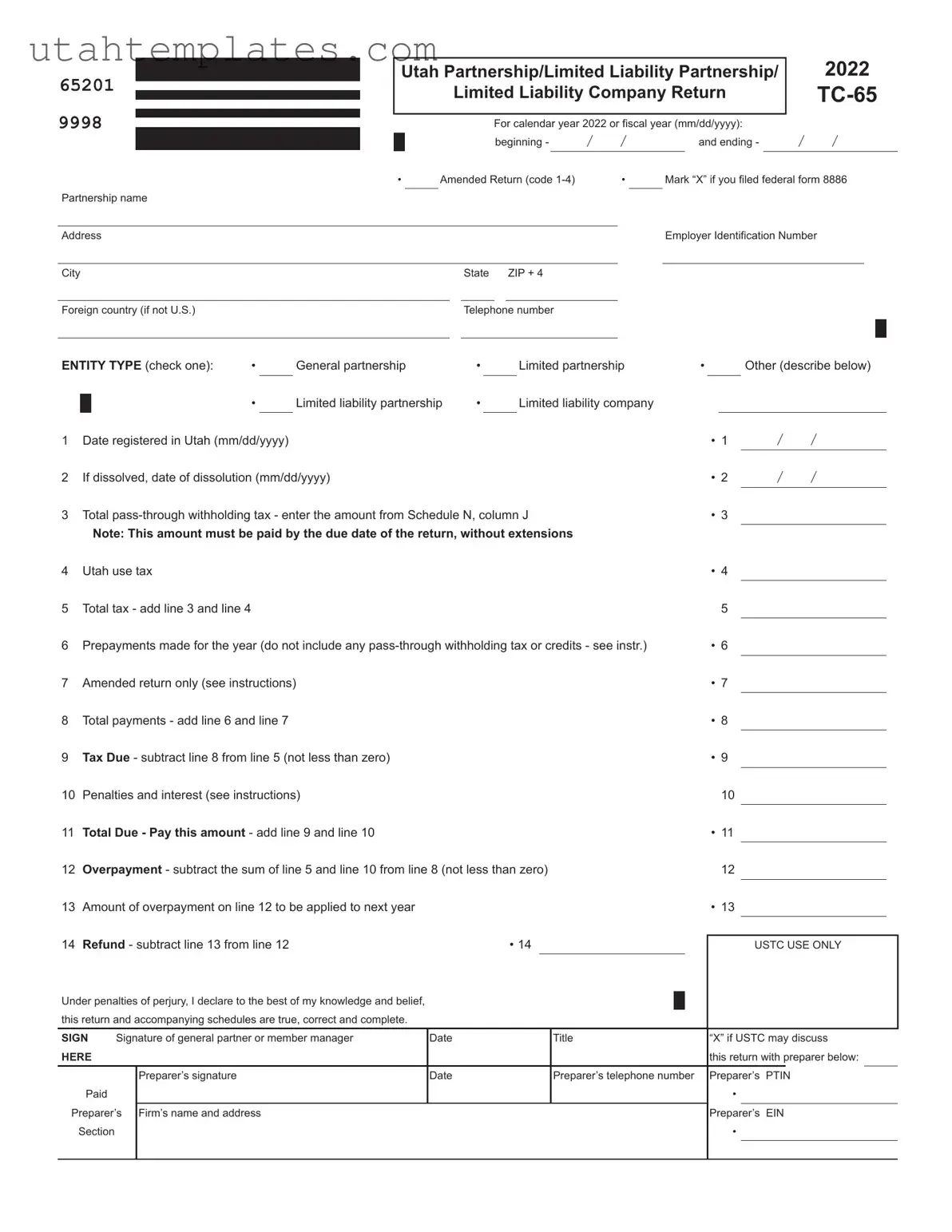

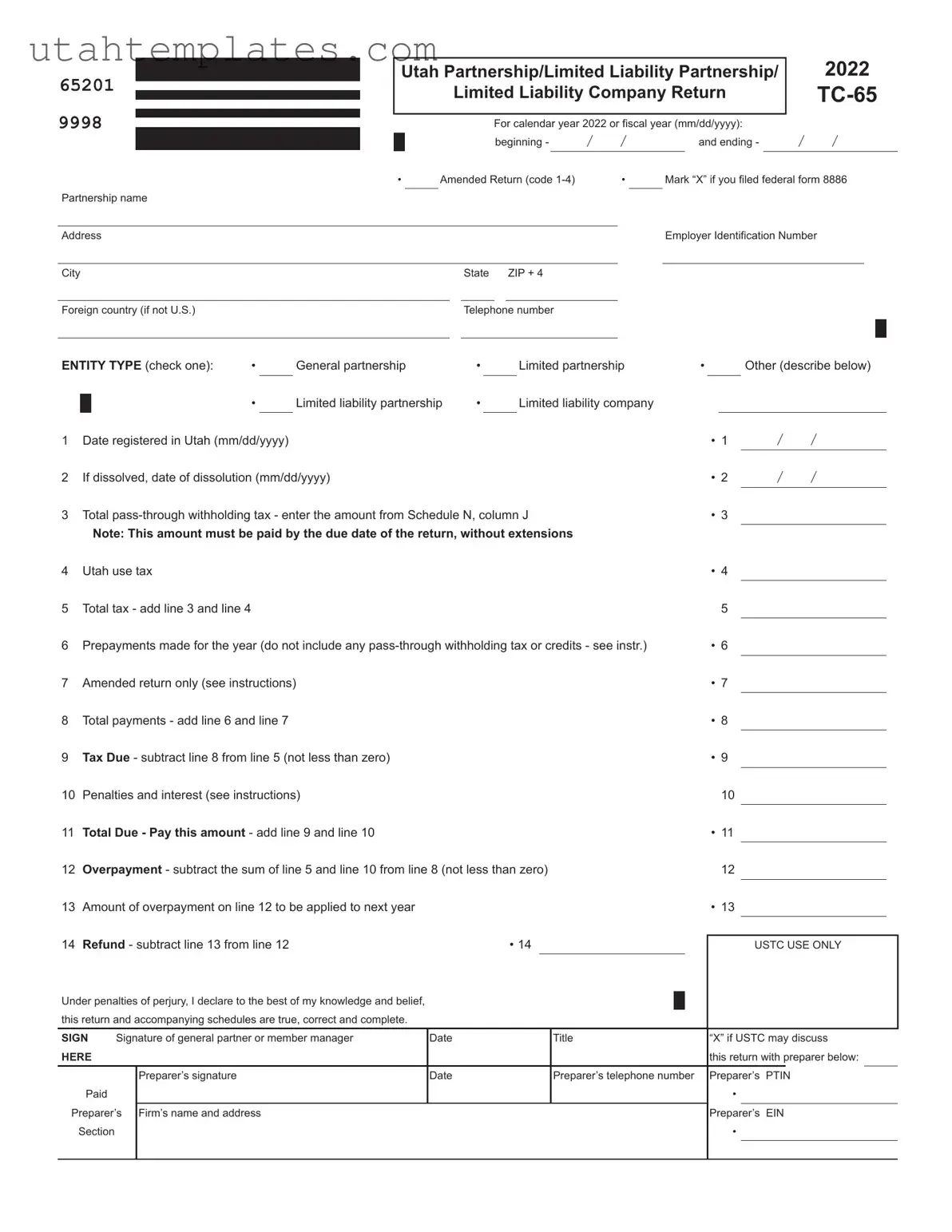

65201

9998

USTC ORIGINAL FORM

Partnership name

Address

City

Utah Partnership/Limited Liability Partnership/ |

|

2022 |

|

|

Limited Liability Company Return |

|

TC-65 |

|

|

For calendar year 2022 or fiscal year (mm/dd/yyyy): |

|

|

|

|

|

beginning - |

/ |

/ |

|

|

and ending - |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

Amended Return (code 1-4) |

|

• |

Mark “X” if you filed federal form 8886 |

|

|

|

|

|

|

|

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

State ZIP + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country (if not U.S.)Telephone number

ENTITY TYPE (check one): |

• |

General partnership |

• |

|

Limited partnership |

• |

|

Other (describe below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Limited liability partnership |

• |

|

Limited liability company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Date registered in Utah (mm/dd/yyyy) |

|

|

|

|

|

|

• 1 |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

If dissolved, date of dissolution (mm/dd/yyyy) |

|

|

|

|

|

• 2 |

/ |

/ |

3 |

Total pass-through withholding tax - enter the amount from Schedule N, column J |

|

• 3 |

|

|

|

|

|

|

|

|

|

Note: This amount must be paid by the due date of the return, without extensions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Utah use tax |

|

|

|

|

|

|

|

|

• 4 |

|

|

|

5 |

Total tax - add line 3 and line 4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Prepayments made for the year (do not include any pass-through withholding tax or credits - see instr.) |

|

• 6 |

|

|

|

|

|

|

|

7 |

Amended return only (see instructions) |

|

|

|

|

|

• 7 |

|

|

|

|

|

|

|

|

|

|

|

8 |

Total payments - add line 6 and line 7 |

|

|

|

|

|

|

• 8 |

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Tax Due - subtract line 8 from line 5 (not less than zero) |

|

|

|

|

|

• 9 |

|

|

|

|

|

|

|

|

|

|

|

10 |

Penalties and interest (see instructions) |

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

11 |

Total Due - Pay this amount - add line 9 and line 10 |

|

|

|

|

|

• 11 |

|

|

|

|

|

|

|

|

|

|

|

12 |

Overpayment - subtract the sum of line 5 and line 10 from line 8 (not less than zero) |

12 |

|

|

|

|

|

|

13 |

Amount of overpayment on line 12 to be applied to next year |

|

|

|

|

|

• 13 |

|

|

|

|

|

|

|

|

|

|

|

14 |

Refund - subtract line 13 from line 12 |

|

|

• 14 |

|

|

|

|

|

|

|

|

|

|

|

USTC USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare to the best of my knowledge and belief, |

|

|

|

|

|

|

|

|

|

this return and accompanying schedules are true, correct and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN |

Signature of general partner or member manager |

Date |

Title |

“X” if USTC may discuss |

HERE |

|

|

|

|

|

|

this return with preparer below: |

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s signature |

Date |

Preparer’s telephone number |

Preparer’s |

PTIN |

Paid |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

Firm’s name and address |

|

|

|

|

Preparer’s |

EIN |

Section |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

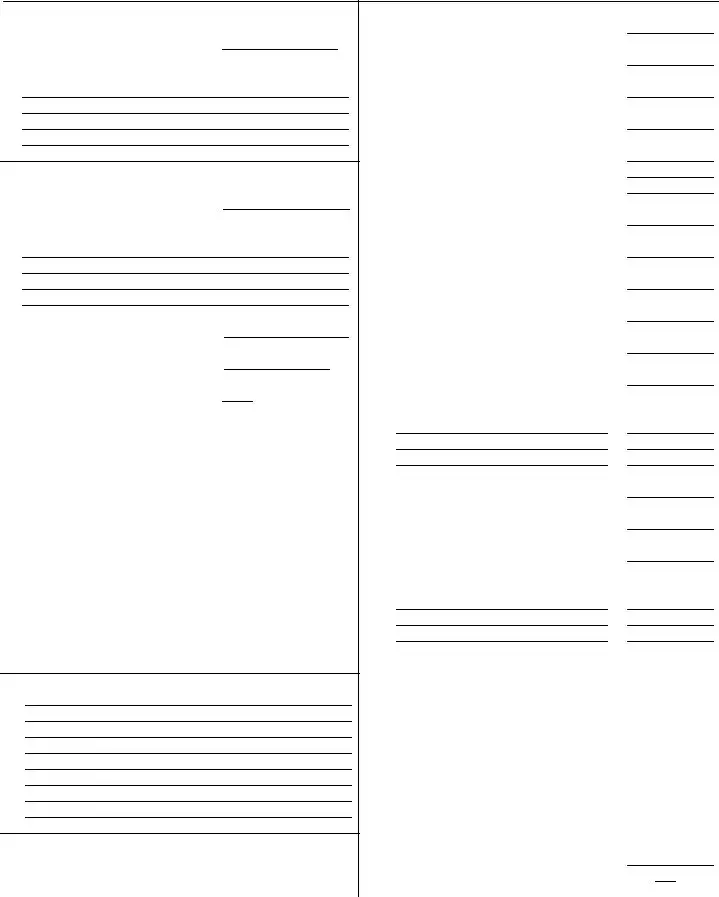

Schedule A - Utah Taxable Income for Pass-through Entity Taxpayers |

TC-65, Sch. A |

65202 |

EIN |

|

|

2022 |

|

|

USTC ORIGINAL FORM |

|

|

|

|

1 |

Net income/loss from federal form 1065, Schedule K, Analysis of Net Income (Loss), line 1 |

• 1 |

|

|

|

|

|

|

2 |

Contributions from federal form 1065, Schedule K, line 13a |

• 2 |

|

|

|

|

|

|

3 |

Foreign taxes from federal form 1065, Schedule K, line 21 |

• 3 |

|

|

|

|

|

|

4 |

Recapture of Section 179 deduction from all federal Schedules K-1, box 20, code M |

• 4 |

|

|

|

|

|

|

5 |

Payroll Protection Program grant or loan addback (see instructions) |

• 5 |

|

|

|

|

|

|

6 |

(Reserved, see instructions) |

• 6 |

7 |

Total income/loss - add lines 1 through 6 |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Total guaranteed payments to partners (see instructions) |

• 8 |

|

|

|

|

|

|

9 |

Health insurance included in guaranteed payments on line 8 |

• 9 |

10 |

Net guaranteed payments to partners - subtract line 9 from line 8 |

10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

Utah net nonbusiness income from TC-20, Schedule H, line 14 |

• 11 |

|

|

|

|

|

|

12 |

Non-Utah net nonbusiness income from TC-20, Schedule H, line 28 |

• 12 |

13 |

Add lines 10 through 12 |

13 |

|

|

|

|

|

|

|

|

|

|

|

14 |

Apportionable income/loss - subtract line 13 from line 7 |

• 14 |

|

|

|

|

|

15 |

Apportionment fraction - enter 1.000000, or TC-20, Schedule J, line 9 or 10, if applicable |

• 15 |

|

|

|

|

|

|

16 |

Utah apportioned business income/loss - multiply line 14 by line 15 |

• 16 |

|

|

|

|

|

17 |

Total Utah income/loss allocated to pass-through entity taxpayers - add line 11 and line 16 |

• 17 |

|

|

|

|

|

|

|

|

|

Schedule H - Utah Nonbusiness Income Net of Expenses |

TC-20, Sch. H |

Pg. 1 |

20261 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with TC-20, |

|

|

|

|

|

|

TC-20S and TC-65) |

|

Note: Failure to complete this form may result in disallowance of the nonbusiness income. |

|

|

|

|

Part 1 - Utah Nonbusiness Income (nonbusiness income allocated to Utah) |

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

|

|

C |

D |

|

E |

|

Type of Utah |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

Utah Nonbusiness Income |

|

Nonbusiness Income |

Utah Nonbusiness |

|

Used to Produce Utah |

Used to Produce Utah |

|

|

|

|

|

|

Asset(s) |

|

|

Nonbusiness Income |

Nonbusiness Income |

|

|

|

1a |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1d |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1e |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Total of column C and column D

3Total Utah nonbusiness income - add column E for lines 1a through 1e

|

Description of direct expenses related to: |

Amount of Direct Expense |

4a |

Line 1a above |

|

|

|

|

|

|

4b |

Line 1b above |

|

|

|

|

|

|

4c |

Line 1c above |

|

|

|

|

|

|

4d |

Line 1d above |

|

|

|

|

|

|

4e |

Line 1e above |

|

|

|

|

|

|

5Total direct related expenses - add lines 4a through 4e

6 |

Utah nonbusiness income net of direct related expenses - subtract line 5 from line 3 |

|

• |

|

|

Column A |

Column B |

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

|

Utah Nonbusiness Income |

Utah Nonbusiness Income |

|

|

7 |

Beginning-of-year assets |

|

|

|

|

|

(enter in Column A the amount from line 2, col. C) |

|

|

|

|

|

|

|

|

|

8End-of-year assets

(enter in Column A the amount from line 2, col. D)

9Sum of beginning and ending asset values (add line 7 and line 8)

10Average asset value - divide line 9 by 2

11Utah nonbusiness assets ratio - line 10, Column A, divided by line 10, Column B (to four decimal places)

12Interest expense deducted in computing Utah taxable income (see instructions)

13Indirect related expenses for Utah nonbusiness income - multiply line 11 by line 12

14 Total Utah nonbusiness income net of expenses - subtract line 13 from line 6 |

|

• |

Enter on: |

TC-20, Schedule A, line 6; |

|

|

|

TC-20S, Schedule A, line 8; or |

|

|

|

|

|

|

TC-65, Schedule A, line 11 |

|

|

Schedule H - Non-Utah Nonbusiness Income Net of Expenses |

TC-20, Sch. H |

Pg. 2 |

20262 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with TC-20, |

|

|

|

|

|

|

TC-20S and TC-65) |

|

Part 2 - Non-Utah Nonbusiness Income (nonbusiness income allocated outside Utah)

|

A |

B |

|

|

C |

D |

|

E |

|

Type of Non-Utah |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

Non-Utah Nonbusiness |

|

Nonbusiness Income |

Non-Utah |

|

|

Used to Produce Non-Utah |

Used to Produce Non-Utah |

|

Income |

|

|

|

Nonbusiness Asset(s) |

|

Nonbusiness Income |

Nonbusiness Income |

|

|

15a |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15b |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15c |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15d |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15e |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16Total of column C and column D

17Total non-Utah nonbusiness income - add column E for lines 15a through 15e

|

Description of direct expenses related to: |

|

|

|

|

|

Amount of Direct Expense |

18a |

Line 15a above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

Line 15b above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18c |

Line 15c above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18d |

Line 15d above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18e |

Line 15e above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

Total direct related expenses - add lines 18a through 18e |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

Non-Utah nonbusiness income net of direct related expenses - subtract line 19 from line 17 |

• |

|

|

|

Column A |

Column B |

|

|

|

|

|

|

|

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

|

|

|

Non-Utah Nonbusiness Income |

Non-Utah Nonbusiness Income |

|

|

|

|

21 |

Beginning-of-year assets |

|

|

|

|

|

|

|

(enter in Column A the amount from line 16, col. C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

End-of-year assets |

|

|

|

|

|

|

|

(enter in Column A the amount from line 16, col. D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

23Sum of beginning and ending asset values (add line 21 and line 22)

24Average asset value - divide line 23 by 2

25Non-Utah nonbusiness assets ratio - line 24, Column A, divided by line 24, Column B (to four decimal places)

26Interest expense deducted in computing non-Utah taxable income (see instructions)

27Indirect related expenses for non-Utah nonbusiness income - multiply line 25 by line 26

28 Total non-Utah nonbusiness income net of expenses - subtract line 27 from line 20 |

• |

Enter on: |

TC-20, Schedule A, line 7; |

|

|

TC-20S, Schedule A, line 9; or |

|

|

TC-65, Schedule A, line 12 |

|

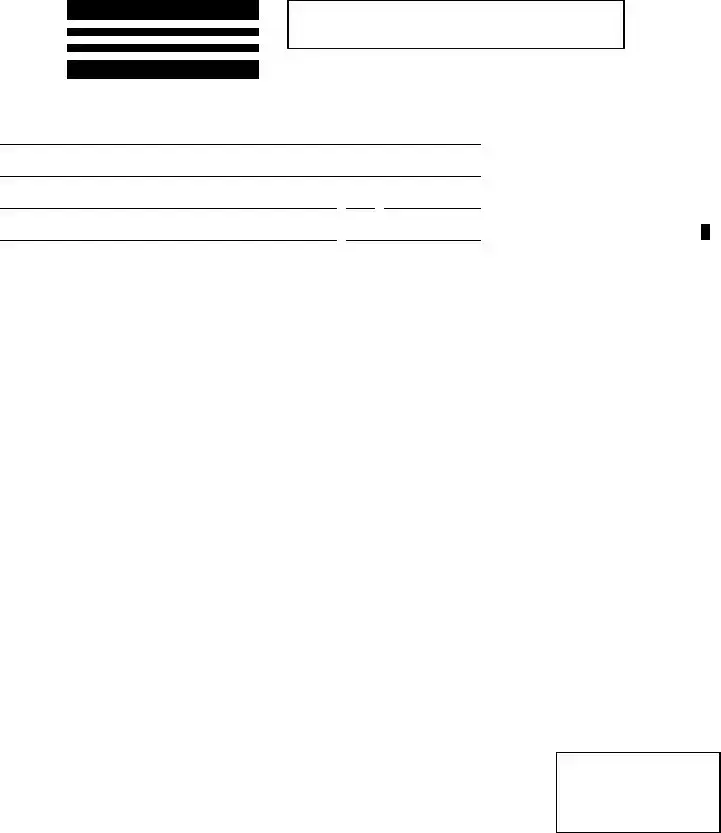

Schedule J - Apportionment Schedule |

TC-20, Sch. J |

Pg. 1 |

20263 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with TC-20, TC-20S, |

|

|

|

|

|

|

TC-20MC and TC-65) |

|

Note: Use this schedule only if the entity does business in Utah and one or more other states and income must be apportioned to Utah.

Briefly describe the nature and location(s) of your Utah business activities:

Apportionable Income Factors

|

|

|

|

|

Column A |

|

Column B |

1 |

Property Factor |

|

|

Inside Utah |

|

Inside and Outside Utah |

|

a |

Land |

• 1a |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

Depreciable assets |

• 1b |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Inventory and supplies |

• 1c |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

Rented property |

• 1d |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

Other allowable property (see instructions) |

• 1e |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

Total tangible property - add lines 1a through 1e |

• 1f |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Property factor - divide line 1f, Column A, by line 1f, Column B (to six decimal places) |

• |

2 |

|

|

|

3 |

Payroll Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Total wages, salaries, commissions and other compensation |

• 3a |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Payroll factor - divide line 3a, Column A, by line 3a, Column B (to six decimal places) |

• |

4 |

|

|

|

5 |

Sales Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

Total sales (gross receipts less returns and allowances) |

|

|

|

• |

5a |

|

b |

Sales delivered or shipped to Utah buyers from outside Utah |

• 5b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c |

Sales delivered or shipped to Utah buyers from within Utah |

• 5c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

Sales shipped from Utah to the United States government |

• 5d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

Sales shipped from Utah to buyers in states where the corp. |

• 5e |

|

|

|

|

|

|

|

has no nexus (corporation not taxable in buyer’s state) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

Rent and royalty income |

• 5f |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

Services and other allowable sales (see instructions) |

• 5g |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h |

Total sales (add lines 5a through 5g) |

• 5h |

• |

|

|

|

|

|

|

|

|

|

|

|

6 Sales factor - line 5h, Column A, divided by line 5h, Column B (to six decimals) |

• |

6 |

|

|

|

|

|

Continued on page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule J - Apportionment Schedule |

TC-20, Sch. J |

Pg. 2 |

20264 EIN |

|

|

2022 |

|

|

|

USTC ORIGINAL FORM |

(use with TC-20, TC-20S, |

|

|

|

|

|

|

|

TC-20MC and TC-65) |

|

|

|

|

|

|

|

|

|

|

|

|

7 All entities - enter your NAICS code here (see instructions) |

• 7 |

|

|

Apportionment Fraction |

|

|

|

|

|

|

|

|

|

Optional apportionment taxpayers (see instructions) complete Part 1 or Part 2. |

|

|

|

|

|

Sales factor weighted taxpayers (see instructions) complete Part 2. |

|

|

|

|

Part 1: Equally-Weighted Three Factor Formula (see instructions for those who qualify)

8 |

Total factors - add lines 2, 4 and 6 |

|

8 |

9 |

Calculate the Apportionment Fraction to SIX DECIMALS |

• |

9 |

|

Divide line 8 by 3 (or the number of factors present) |

|

|

Part 2: Sales Factor Formula (see instructions for those who qualify) |

|

|

10 |

Apportionment Fraction - enter the six-decimal sales factor from line 6 |

• |

10 |

Enter the fraction from line 9 or line 10, above, as follows:

TC-20 filers: Enter on TC-20, Schedule A, line 12

TC-20S filers: Enter on TC-20S, Schedule A, line 12

TC-20MC filers: Enter on TC-20MC, Schedule A, where indicated

TC-65 filers: Enter on TC-65, Schedule A, line 15

Schedule K - Partners’ Distribution Share Items |

|

|

TC-65, Sch. K |

65203 EIN |

|

|

2022 |

USTC ORIGINAL FORM |

|

|

|

Number of Schedules K-1 attached to this return |

• |

|

|

|

|

|

|

Income/Loss

Deductions

Utah Credits

Federal Amount |

Utah Amount |

1Ordinary business income/loss

2Net rental real estate income/loss

3 Other net rental income/loss

4 Guaranteed payments

5a U.S. government interest income

5b Municipal bond interest income

5c Other interest income

6Ordinary dividends

7 Royalties

8 Net short-term capital gain/loss

9 Net long-term capital gain/loss

10 Net Section 1231 gain/loss

11 Recapture of Section 179 deduction

12 Other income/loss (describe)

13Section 179 deduction

14Contributions

15Foreign taxes paid or accrued

16Other deductions (describe)

17 Utah nonrefundable credits - enter the name of the Utah credit |

Code |

|

Credit Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 Utah refundable credits - enter the name of the Utah credit |

Code |

|

Credit Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Total Utah tax withheld on behalf of all partners from Schedule N, column J

|

Schedule K-1 - Partner’s Share |

TC-65, Sch. K-1 |

65204 |

of Utah Income, Deductions and Credits |

2022 |

USTC ORIGINAL FORM

Partnership Information

APartnership’s EIN:

BPartnership’s name, address, city, state, and ZIP code

Partner Information

C Partner’s SSN or EIN:

D Partner’s name, address, city, state, and ZIP code

EPartner’s phone number

F Percent of ownership

G Enter “X” if limited partner or member

H Entity code from list below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-- |

I = Individual |

|

|

P = Gen’l Partnership |

|

|

|

C = Corporation |

|

L = Limited Partnership |

|

|

|

Codes |

|

|

|

|

S = S Corporation |

|

B = LLC |

|

|

|

|

R = LLP |

|

-- |

N = Nonprofit Corp. |

|

T = Trust |

|

|

|

|

O = Other |

|

|

|

|

|

|

|

I |

Enter date: |

|

/ |

/ |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

affiliated |

|

|

|

|

withdrawn |

|

|

|

|

|

|

|

|

|

Partner’s Share of Apportionment Factors |

|

|

|

|

|

|

|

|

|

|

|

|

Utah |

|

|

|

|

|

Total |

J |

Property |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K |

Payroll |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

Sales |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Information

Note: To complete lines 1 through 16:

*Utah residents, enter the amounts from federal Schedule K-1.

*Utah nonresidents, see instructions to calculate amounts.

All filers complete lines 17 through 19, if applicable.

Partner’s Share of Utah Income, Deductions and Credits

1Utah ordinary business income/loss

2Utah net rental real estate income/loss

3 Utah other net rental income/loss

4 Utah guaranteed payments

5a Utah U.S. government interest income

5b Utah municipal bond interest income

5c Utah other interest income

6Utah ordinary dividends

7 Utah royalties

8 Utah net short-term capital gain/loss

9 Utah net long-term capital gain/loss

10 Utah net Section 1231 gain/loss

11 Utah recapture of Section 179 deduction

12 Utah other income/loss (describe)

13Utah Section 179 deduction

14Contributions

15Foreign taxes paid or accrued

16Utah other deductions (describe)

17Utah nonrefundable credits:

Name of Credit |

Code |

Credit Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 Utah refundable credits:

Name of Credit |

Code |

Credit Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19Utah tax withheld on behalf of partner “X” if withholding waiver applied for

Schedule N - Pass-through Entity Withholding Tax |

|

TC-65, Sch. N |

65205 EIN |

|

|

|

2022 |

USTC ORIGINAL FORM

A partnership with nonresident individual partners, resident/nonresident business partners, or resident/nonresident trust or estate partners must complete the information below to calculate the Utah withholding tax for these partners. See instructions for column G, column H and column I.

WITHHOLDING WAIVER CLAIMED under §59-10-1403.2(5): If partners will pay the Utah tax on their own returns: |

|

• |

Enter "1" to claim a waiver for ALL partners (enter "X" in column B and "0" in column F for all partners) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter "2" to claim a waiver for SOME partners (enter "X" in column B and "0" in column F for those partners claimed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

See Schedule N instructions for liability responsibilities when claiming a waiver. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

Name of partner |

|

|

|

|

E |

Income/loss |

F |

4.85% of income - |

G |

Mineral production |

J Withholding tax |

B |

Withholding waiver for this partner |

|

|

attributable to Utah |

|

|

E times .0485 |

|

|

|

withholding credit |

|

to be paid by |

|

(enter “X” in column B and “0” in column F) |

|

|

plus Utah source |

|

|

(not less than zero) H |

Upper-tier pass- |

|

this partnership |

C |

SSN or EIN of partner |

|

|

|

|

|

|

guaranteed pymts |

|

|

|

|

|

|

|

through withholding |

|

F less G, H and I |

D |

Partner’s % of income or ownership |

|

|

(see instructions) |

|

|

|

|

I Tax paid by PTE |

|

(not less than 0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1 |

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

#7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report the partner’s pass-through withholding |

|

|

|

|

Total Utah withholding tax to be paid by this partnership: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

tax from column J on Schedule K-1, line 19 |

|

|

|

|

Enter on TC-65, line 3 and on Sch. K, line 19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credits Received from Upper-tier Pass-through Entities |

TC-250 |

25201 and Mineral Production Withholding Tax Credit on TC-675R |

2022 |

EIN |

|

|

(use with TC-20S, TC-41 and TC-65) |

USTC ORIGINAL FORM

Part 1 - Utah Nonrefundable Credits Received from Upper-tier Pass-through Entities

Upper-tier pass-through entity EIN from Utah Sch. K-1, box “A”

1

2

3

4

5

6

|

|

|

|

UT nonrefundable |

Name of upper-tier pass-through entity |

|

Credit |

credit from |

from Utah Schedule K-1, box “B” |

|

Code |

Utah Sch. K-1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter these credits on Utah TC-20S Sch. K, line 18, or TC-41 Sch. A, Part 3 or 4, or TC-65 Sch. K, line 17, using the credit code above. Combine amounts for the same codes.

Part 2 - Utah Refundable Credits Received from Upper-tier Pass-through Entities

Upper-tier pass-through entity EIN from Utah Sch. K-1, box “A”

Name of upper-tier pass-through entity |

Credit |

UT refundable credit |

from Utah Schedule K-1, box “B” |

Code |

from Utah Sch. K-1 |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Enter these credits on Utah TC-20S Sch. K, line 19, or TC-41 Sch. A, Part 5, or TC-65 Sch. K, line 18, using the credit code above. Combine amounts for the same codes.

Part 3 - Utah Mineral Production Withholding Tax Credit Received on TC-675R

|

|

Mineral production |

Producer EIN from |

|

withholding from |

TC-675R, box “2” |

Producer’s name from TC-675R, box “1” |

TC-675R, box “6” |

1

2

3

4

5

6

7

8

9

10

Total Utah mineral production withholding tax credit received on TC-675R

Enter total credit on Utah TC-20S Sch. K, line 19, or TC-41 Sch. A, Part 5, or TC-65 Sch. K, line 18, using credit code 46.