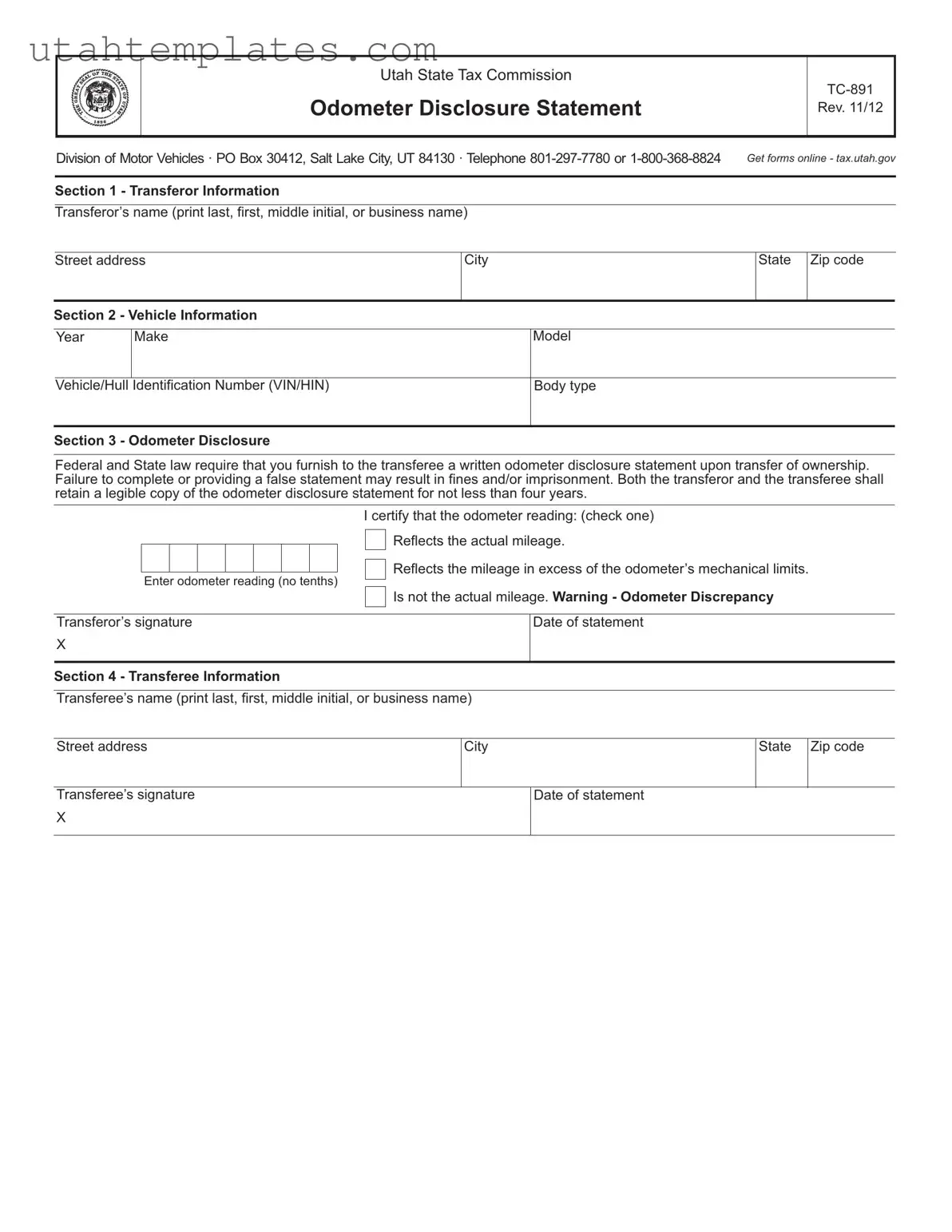

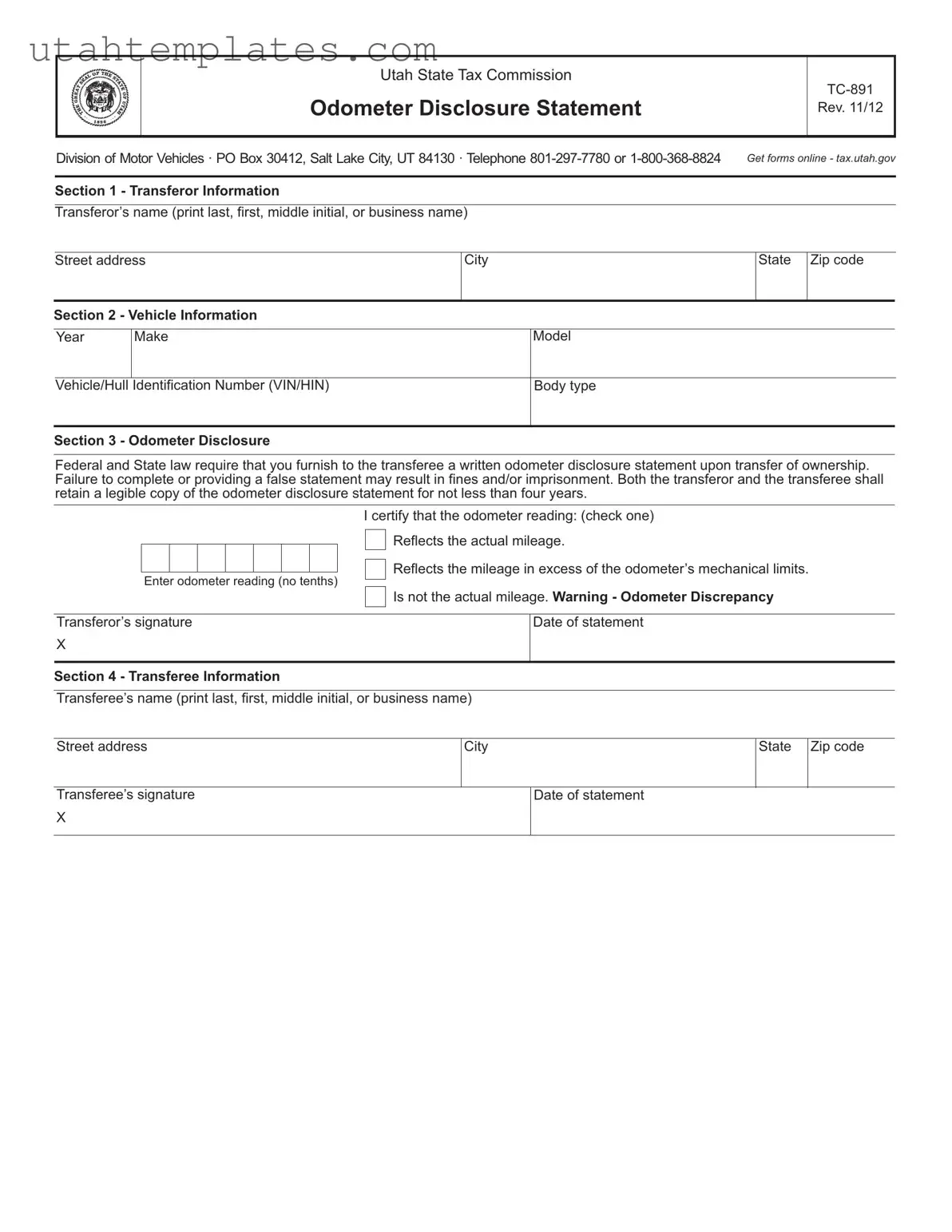

Filling out the Utah TC-891 form can be straightforward, but there are common mistakes that individuals often make. One frequent error is failing to provide complete transferor information. It is crucial to include the full name, street address, city, state, and zip code. Omitting any of these details can lead to complications in the vehicle transfer process.

Another common mistake is related to the vehicle information. When entering the year, make, model, and Vehicle Identification Number (VIN), accuracy is essential. Errors in this section can result in discrepancies that may delay the registration or transfer of ownership.

Many individuals overlook the importance of the odometer disclosure. It is vital to check the correct box that reflects the odometer reading. Failing to do so, or providing an incorrect reading, can lead to legal consequences. The law mandates that the disclosure must be accurate, and any false statements can result in fines or other penalties.

Additionally, individuals often forget to include their signature and the date on the form. Both the transferor and transferee must sign and date the document for it to be valid. Without these signatures, the form may be considered incomplete.

Another mistake involves not retaining a copy of the odometer disclosure statement. Both parties are required to keep a legible copy for at least four years. Failing to do so may complicate any future disputes regarding the vehicle’s mileage.

Some people also neglect to provide complete transferee information. Just as with the transferor, it is essential to include the full name, street address, city, state, and zip code for the person receiving the vehicle. Incomplete information can hinder the transfer process.

Misunderstanding the definition of odometer discrepancies can lead to errors. If the odometer does not reflect the actual mileage, it is important to check the appropriate box and provide a clear explanation. This ensures transparency and compliance with state regulations.

Lastly, individuals may rush through the process, leading to careless mistakes. Taking the time to review the form before submission can help catch errors that could complicate the transfer. Ensuring all information is accurate and complete is essential for a smooth transaction.