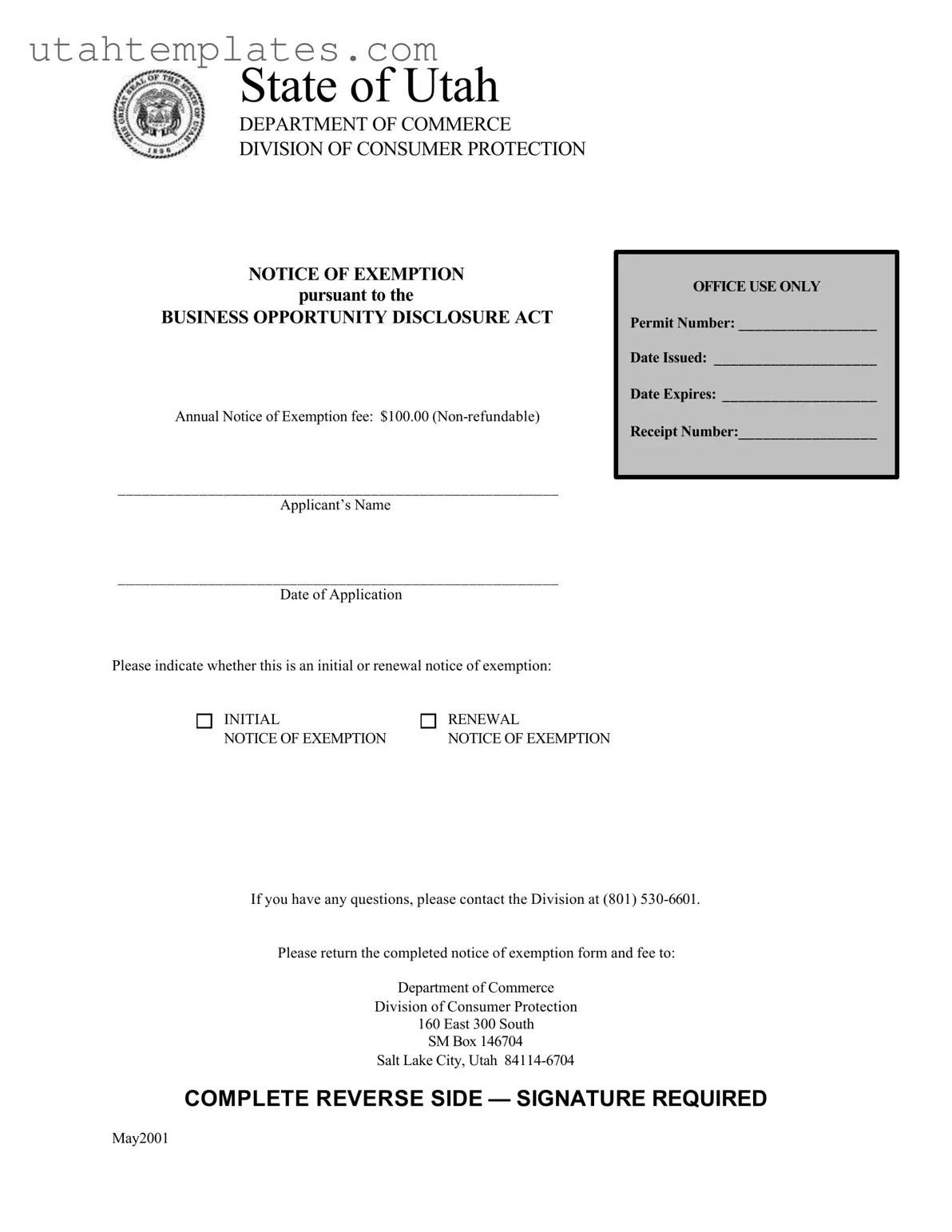

Blank Utah Department Commerce Notice Form

The Utah Department Commerce Notice form is a crucial document for businesses seeking exemption under the Business Opportunity Disclosure Act. This form requires applicants to provide detailed information about their business, including their name, address, and compliance with federal regulations. Completing this form accurately and submitting it with the required fee is essential to ensure your business operates legally in Utah.

Launch Utah Department Commerce Notice Editor Here

Blank Utah Department Commerce Notice Form

Launch Utah Department Commerce Notice Editor Here

Need to check this off quickly?

Fill out Utah Department Commerce Notice online without dealing with paper.

Launch Utah Department Commerce Notice Editor Here

or

Free PDF File